WTI Crude Futures - Deeper Rebound May be Developing

rhboskres

Publish date: Tue, 25 Sep 2018, 09:50 AM

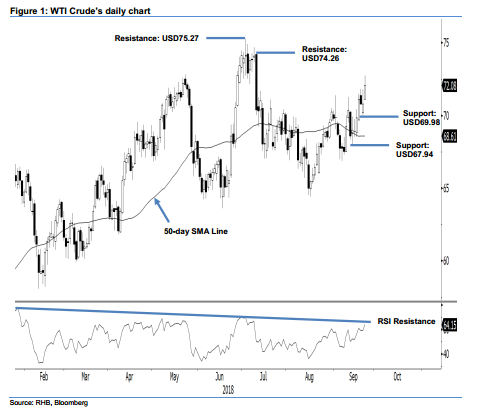

Initiate long positions as the bulls are taking back control. The latest session saw the WTI Crude form a white candle and successfully closing above the previous immediate resistance of USD71.40 – after it was tested four times over the last three weeks. The commodity was generally trending higher during the session, with a low and high posted at USD71.14 and USD72.74, before settling at USD72.08, implying a gain of USD1.30. As mentioned in our prior reports, a decisive break of said previous immediate resistance could be a signal that the bulls are taking back control over the commodity’s trend – this implies that the bulls may retest USD75.27, ie the 20-month high point. With this, we switch our near-term trading bias to positive.

Our previous short positions, initiated on 12 Jul after the WTI Crude plunged below the USD72.83 level – were closed out yesterday. On the expectations that the bulls have regained control, we initiate long positions at the latest closing level. For risk management, a stop-loss can be set at below USD67.94 mark.

We revise the immediate support to USD69.98, which was the low of 21 Sep. This is followed by USD67.94, ie the low of 14 Sep. Moving up, immediate resistance is now expected to emerge at USD74.26. This is followed by USD75.27, ie the high of 3 Jul.

Source: RHB Securities Research - 25 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024