FKLI & FCPO - FKLI: Pushing Back the Bulls

rhboskres

Publish date: Tue, 25 Sep 2018, 09:51 AM

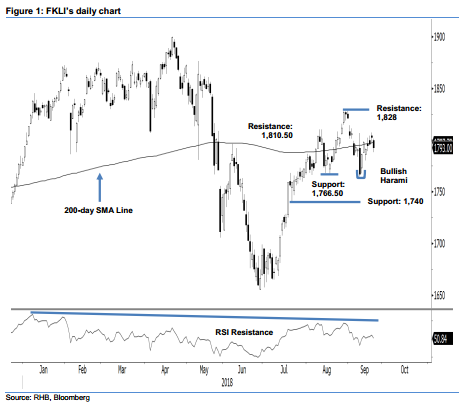

Maintain long position. The FKLI formed a black candle in yesterday’s session. At the close, it slipped back below 1,800 pts and the 200-day SMA line – indicating the bears were in control. At the intra-day, the index declined from a high of 1,801.5 pts to a low of 1,788.5 pts, before settling 10 pts weaker at 1,793 pts. While its failure to remain above both 1,800 pts and the 200-day SMA line suggests the bulls are finding it hard to penetrate these levels over the past two weeks. Nevertheless, there is also lack of price signals to point to a clear price rejection from these levels as well. If this happens, it may suggest that a deeper retracement is developing. For now, provided the immediate support of 1,766.5 pts is not invalidated, we are keeping our near-term positive trading bias.

As there is no clear evidence to suggest the index’s positive trajectory has reached to an end, we continue to suggest that traders remain in long positions. For risk management purposes, a stop-loss can be set below the 1,766.50-pt mark, in line with our long recommendation of 1,812 pts – also the closing level of 27 Aug.

We peg the immediate support at 1,766.50 pts, 31 Jul’s low. This is followed by1,740 pts, the low of 20 Jul. Towards the upside, immediate resistance is at 1,810.5 pts, the highs of 9 and 10 Aug. The following resistance is expected at 1,828 pts, the high of 29 Aug.

Source: RHB Securities Research - 25 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024