COMEX Gold - Consolidation Mode Still on

rhboskres

Publish date: Wed, 26 Sep 2018, 05:02 PM

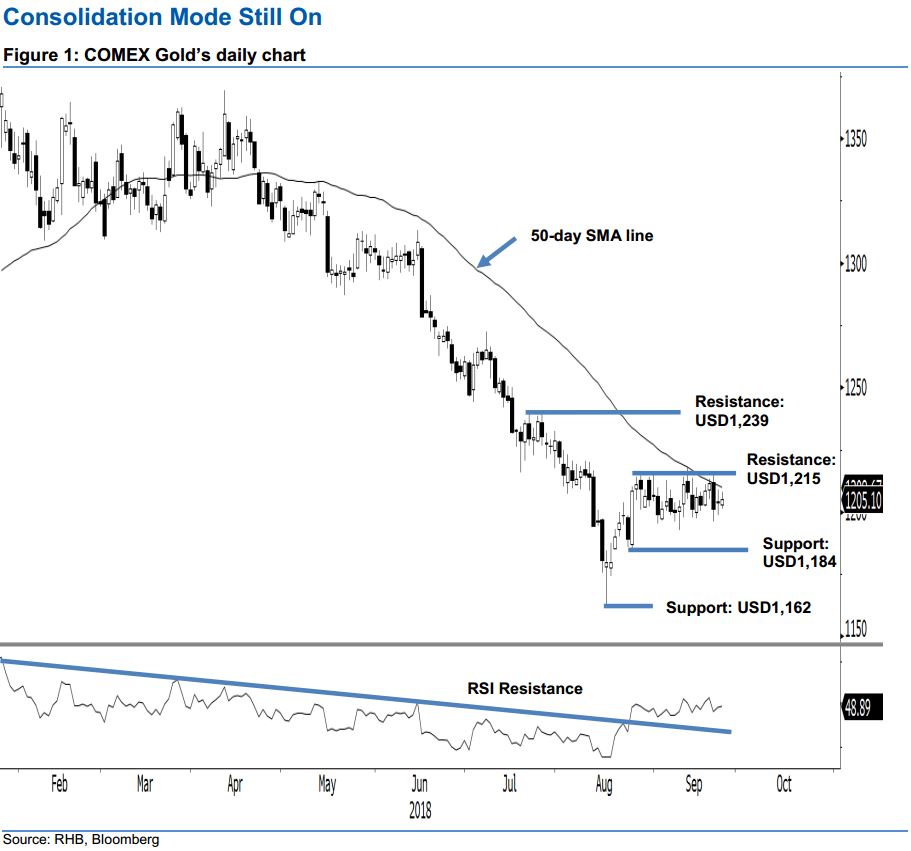

Maintain long position pending the end of the consolidation phase. The COMEX Gold ticked up marginally by USD0.70 to close at USD1,205.10 in the latest trading. This is after it ranged between a low and high of US1,201.30 and USD1,207.90. The pattern that developed over the past four weeks still suggests that the precious metal is in sideways consolidation mode, below both the immediate resistance of USD1,215 and the 50-day SMA line. Once this consolidation phase ends, chances are high for the commodity to extend its rebound. Towards the downside, breaching below the immediate support of USD1,184 would invalidate the current positive bias tone. Until this happens, we are keeping our near-term positive trading bias.

With the overall technical picture still pointing towards a rebound extension, we continue to advise traders to keep long positions on the COMEX Gold. Recall that we initiated these positions after the commodity breached above the USD1,207.60 mark on 12 Sep. For risk management purposes, a stop-loss can be set at below the USD1,184 threshold.

First support is expected to emerge at USD1,184, which was the low of 24 Aug. This is followed by the USD1,162 critical support registered on 16 Aug – this was also the YTD low. On the flip side, the immediate resistance is at USD1,215, or the low of 20 Jul. This is followed by the USD1,239 level, ie 26 Jul’s high.

Source: RHB Securities Research - 26 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024