E-mini Dow Futures - Bulls Pause to Digest

rhboskres

Publish date: Wed, 26 Sep 2018, 05:03 PM

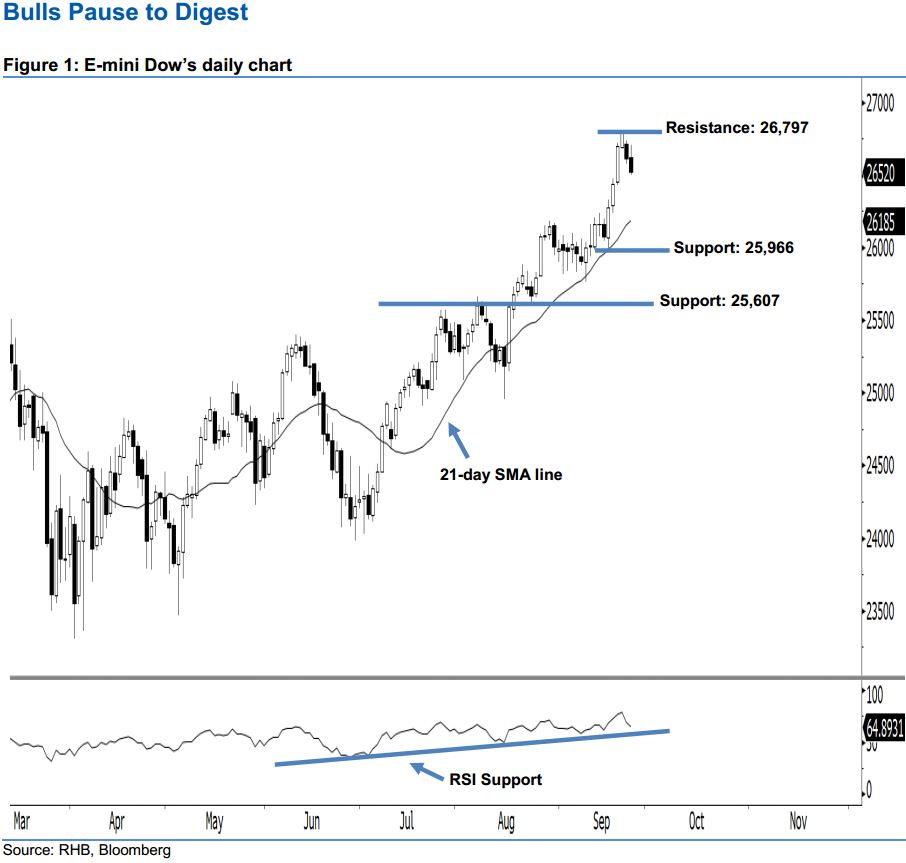

Stay long, with a trailing-stop set below the 25,966-pt support. The E-mini Dow formed another black candle last night. It lost 90 pts to close at 26,520 pts, off its high of 26,704 pts and low of 26,501 pts. However, we believe the near-term uptrend is not over yet, as the index has continued to hold above the rising 21-day SMA line. Technically speaking, the formation of 24-25 Sep’s black candles indicates profit-taking activities after the recent gains, in our view. We expect the market to rise further if the immediate 26,797-pt resistance is taken out decisively in the coming sessions.

As seen in the chart, we anticipate the immediate support level at 25,966 pts, which was the low of 18 Sep. If this level is taken out, look to 25,607 pts – ie the previous low of 23 Aug – as the next support. To the upside, we maintain the near-term resistance level at the 26,797-pt historical high. This is followed by the 27,000-pt psychological mark.

Hence, we advise traders to maintain long positions, given that we previously recommended initiating long above the 24,600-pt level on 11 Jul. A trailing-stop is preferably set below the 25,966-pt threshold in order to lock in part of the profits.

Source: RHB Securities Research - 26 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024