COMEX Gold - Bulls Continue to Pause

rhboskres

Publish date: Thu, 27 Sep 2018, 04:46 PM

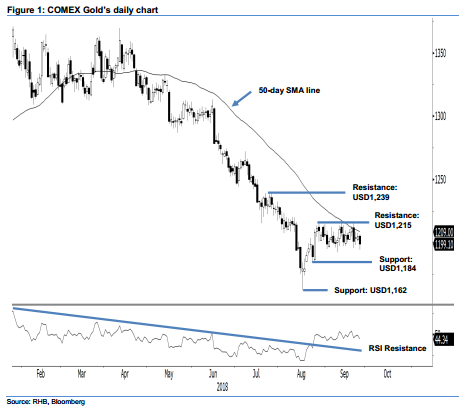

Sideway consolidation still on; Maintain long positions. The COMEX Gold formed a black candle in the latest session. At the closing, it eased USD6 to close at MYR1,199.1, after oscillating between a low and high of UD1,194.6 and USD1,206.9. The commodity’s overall technical picture over the past four weeks remains constructive – a sideway consolidation below both the immediate resistance of USD1,215 and the 50-day SMA line. If our expectation of a sideway consolidation is correct, chances are high that the ongoing consolidation is reaching its final leg, and its upward move may resume in the near future – to be confirmed by a firm upside breach of both the said immediate resistance and 50-day SMA line. Based on these interpretations, we are keeping our near term positive trading bias.

With the price pattern developed over the past four weeks remaining positive for an upward move extension, we continue to advise traders to keep long positions. Recall that we initiated these positions after the commodity breached above the USD1,207.60 mark on 12 Sep. For risk management purposes, a stop loss can be set at below the USD1,184 threshold.

Immediate support is eyed at USD1,184, which was the low of 24 Aug. This is followed by the USD1,162 critical support registered on 16 Aug – this was also the YTD low. On the other hand, the immediate resistance is at USD1,215, or the low of 20 Jul. This is followed by the USD1,239 level, ie 26 Jul’s high.

Source: RHB Securities Research - 27 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024