COMEX Gold - Bouncing Off Immediate Support

rhboskres

Publish date: Mon, 01 Oct 2018, 08:54 AM

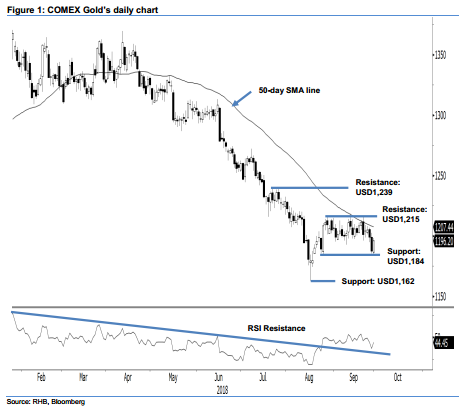

Maintain long positions as bulls are defending the immediate support. The COMEX Gold formed a white candle in the latest session - after it came near to testing the immediate support of USD1,184, indicating that the bulls are probably re-emerging near the support level. The session’s low and high were at UD1,184.3 and USD1,198, before ending at USD1,196.2, indicating a gain of USD8.8. Overall, the near term bias for the commodity to extend its corrective rebound would still be valid, provided the said immediate support is not breached. The ongoing corrective rebound phase set in after the commodity experienced a steep retracement between January-August – which sent the daily RSI into the oversold territory. Hence, we are keeping our near term positive trading bias.

As there was a positive price reaction near the said immediate support, we continue to advise traders to keep their long positions. Recall that we initiated these positions after the commodity breached above the USD1,207.60 mark on 12 Sep. For risk management purposes, a stop loss can be set below the USD1,184 threshold.

We still peg the immediate support at USD1,184, which was the low of 24 Aug. This is followed by the USD1,162 critical support registered on 16 Aug – this was also the YTD low. Moving up, the immediate resistance is at USD1,215, or the low of 20 Jul, while the second resistance is at USD1,239 level, ie 26 Jul’s high.

Source: RHB Securities Research - 1 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024