WTI Crude Futures - Looking Good

rhboskres

Publish date: Mon, 01 Oct 2018, 08:55 AM

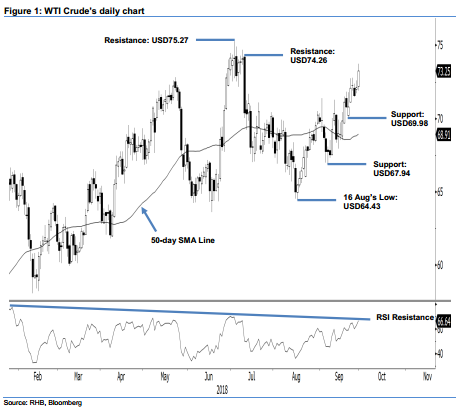

Maintain long positions as the bulls are still in control. The WTI Crude performed positively in the latest session, it ended USD1.13 higher to close at USD73.25. The session’s low and high were at USD71.88 and USD73.73. The latest positive session is an extension of the rebound since the low of 16 Aug’s USD64.43 (also the 200-day SMA at that point). In the near term, provided the immediate support of USD69.98 is not breached, the probability for the commodity to retest its 20-month high of USD75.27 would still be good. Based on this, we are keeping our near term positive trading bias.

As the bulls continue to show signs of control over the near term, we maintain our recommendation for traders to keep to their long positions. Recall that we opened these positions at USD72.08, the closing level on 24 Sep. For risk management, we revise the trailing stop to below the USD69.98 mark.

Immediate support may be found at USD69.98, which was the low of 21 Sep. The second support is at USD67.94, ie the low of 14 Sep. On the flip side, the immediate resistance is pegged at USD74.26. This is followed by USD75.27, ie the high of 3 Jul.

Source: RHB Securities Research - 1 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024