Hang Seng Index Futures - Still Positive

rhboskres

Publish date: Mon, 01 Oct 2018, 08:57 AM

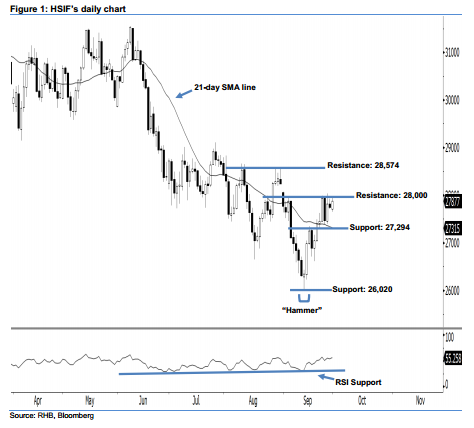

Near-term sentiment remains positive; stay long. The HSIF formed a white candle last Friday. It settled at 27,877 pts, after oscillating between a high of 27,935 pts and low of 27,649 pts. Technically speaking, the index has recouped the previous session’s losses and remained above the 21-day SMA line. This indicates that the rebound, which started from 12 Sep’s “Hammer” pattern, may continue. In addition, the 14-day RSI indicator is now rising without being overbought, improving the bullish sentiment. Overall, we stay bullish on the HSIF’s near term outlook.

As seen in the chart, we anticipate the immediate support at 27,294 pts, which was the low of 20 Sep. The next support is maintained at 26,020 pts, determined from the low of 12 Sep’s “Hammer” pattern. On the other hand, the near-term resistance is seen at the 28,000-pt psychological spot. This is followed by 28,574 pts, situated at the previous high of 30 Aug.

Hence, we advise traders to stay long, in line with our initial recommendation to have long positions above the 26,700-pt level on 14 Sep. A trailing stop is advisable below the 27,294-pt threshold in order to lock in part of the profits.

Source: RHB Securities Research - 1 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024