FKLI & FCPO - FKLI: Hovering Around Resistance Level

rhboskres

Publish date: Mon, 01 Oct 2018, 08:59 AM

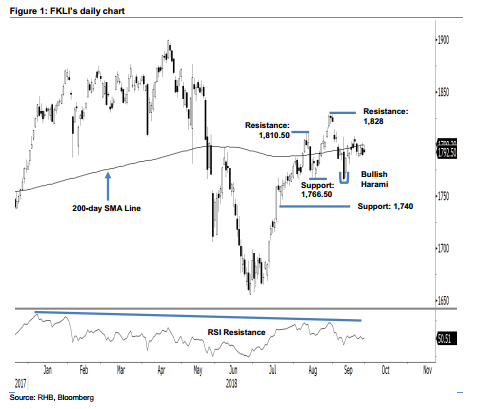

Maintain long positions as no signals of reversal are spotted. Last Friday, the FKLI edged up by 2.5 pts to close at 1,792.5 pts, after moving between a low and high of 1,792 pts and 1,798.5 pts. The latest session continued to suggest that the index is still consolidating around both the 200-day SMA line and the 1,800-pt mark. In our view, these two levels are tough resistance points. If the bulls breach above these levels decisively, chances are high that its uptrend would be extended. Towards the downside, the risk of a deeper retracement may develop should the immediate support of 1,766.5 pts be breached. Based on these observations, we are keeping our near-term positive trading bias.

With no price signals to suggest the upward bias has reached an end, we continue to suggest that traders remain in long positions. For risk management purposes, a stop-loss can be set below the 1,766.50-pt mark, in line with our long recommendation of 1,812 pts – also the closing level of 27 Aug.

Towards the downside, immediate support is set at 1,766.50 pts, 31 Jul’s low. This is followed by 1,740 pts, the low of 20 Jul. On the flip side, immediate resistance is at 1,810.5 pts, the highs of 9 and 10 Aug. This is followed by 1,828 pts, the high of 29 Aug.

Source: RHB Securities Research - 1 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024