FCPO - Bulls Attempting a Comeback

rhboskres

Publish date: Wed, 26 Sep 2018, 04:51 PM

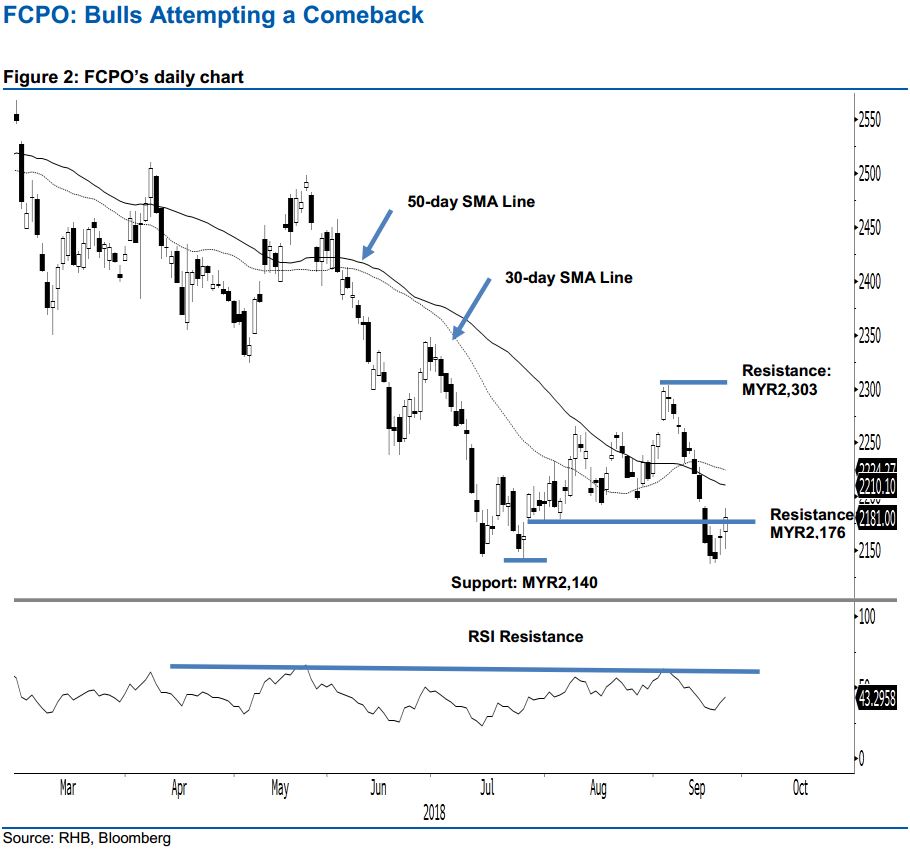

Maintain short positions until clearer signals of a deeper rebound emerge. The FCPO formed a white candle in the latest session and at the closing, marginally crossed the immediate resistance of MYR2,176 (we deem this resistance as still valid, as it was indecisively breached). The session’s low and high were at MYR2,151 and MYR2,189, and the FCPO closed MYR18 stronger at MYR2,181. While the commodity managed to push itself further away from the immediate support of MYR2,140 in the latest sessions, based on the daily chart, there is still no clear evidence to suggest a deeper rebound is taking place. Additionally, both the 30-day and 50-day SMA lines – which continued to edge lower – signal a negative bias. Hence, we keep to our near-term negative trading bias.

As there is still no sign that the negative price trend has reached to an end, we continue to recommend that traders remain in short positions. We initiated these positions at MYR2,222, the closing level of 14 Sep. To manage risks, a trailing-stop can be set at the breakeven level.

Towards the downside, immediate support is set at MYR2,140, the low of 25 Jul. This is followed by MYR2,100, a round figure. Overhead resistance is still at MYR2,176, the low of 31 Jul – as it was indecisively breached in the latest close. This is followed by MYR2,303, the high of 5 Sep.

Source: RHB Securities Research - 26 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024