FKLI & FCPO - FKLI: Bulls Testing Resistance

rhboskres

Publish date: Tue, 02 Oct 2018, 08:58 AM

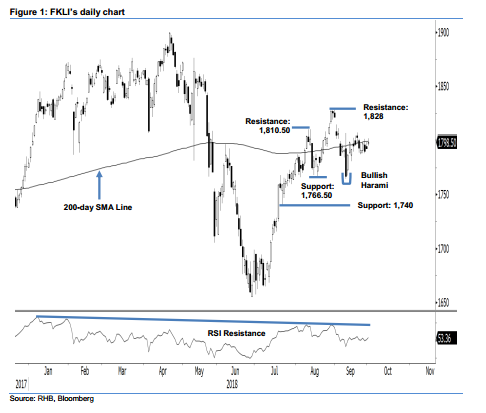

Maintain long positions. The latest session continued to see the FKLI testing the 200-day SMA line, which latest reading coincides with the 1,800-pt mark. The session’s low and high were registered at 1,795 pts and 1,802 pts, before it ended 3.5 pts higher at 1,798.5 pts. Despite the positive performance, the bulls were still not able to decisively break away from the consolidation phase around the said resistance level – in development over the past two months. A firm breakout from this level is needed to signal the resumption of an upward move. For now, the risk for a deep retracement is considered low, as there is no price rejection signal spotted either. Hence, we are keeping to our near-term positive trading bias.

As the overall positive bias is still firmly in place, without any signs of ending, we continue to suggest that traders remain in long positions. For risk management purposes, a stop-loss can be set below the 1,766.50-pt mark, in line with our long recommendation of 1,812 pts – also the closing level of 27 Aug.

The immediate support is maintained at 1,766.50 pts, 31 Jul’s low. The second support is at 1,740 pts, the low of 20 Jul. Towards the upside, the immediate resistance is at 1,810.5 pts, the highs of 9 and 10 Aug. This is followed by 1,828 pts, the high of 29 Aug.

Source: RHB Securities Research - 2 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024