E-mini Dow Futures - Inching Higher

rhboskres

Publish date: Wed, 03 Oct 2018, 04:27 PM

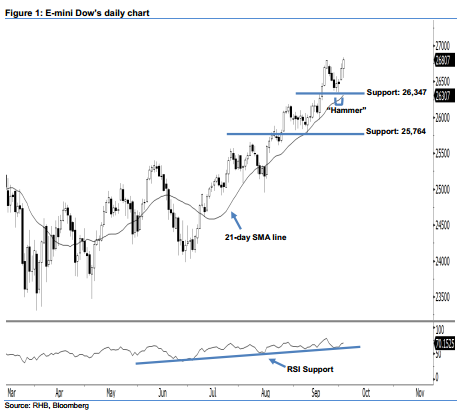

Stay long, with a new trailing-stop set below the 26,347-pt level. The E-mini Dow’s upside strength continued as expected after it ended higher and formed another white candle yesterday. It rose 129 pts to close at 26,807 pts, off its high of 26,837 pts and low of 26,552 pts. As the index posted a white candle for the second consecutive session and registered a new record high, this can be viewed as the bulls extending the buying momentum. Overall, we believe the upside swing from 28 Sep’s “Hammer” pattern would likely continue in the coming sessions.

According to the daily chart, the immediate support level is seen at 26,347 pts, which was the low of 28 Sep’s “Hammer” pattern. The next support is seen at 25,764 pts, obtained from the low of 11 Sep. Towards the upside, we are eyeing the near-term resistance level at the 27,000-pt psychological spot. This is followed by the 27,500-pt round figure.

To re-cap, on 11 Jul, we initially recommended traders to initiate long positions above the 24,600-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 26,347-pt threshold. This is in order to lock in a larger part of the profits.

Source: RHB Securities Research - 3 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024