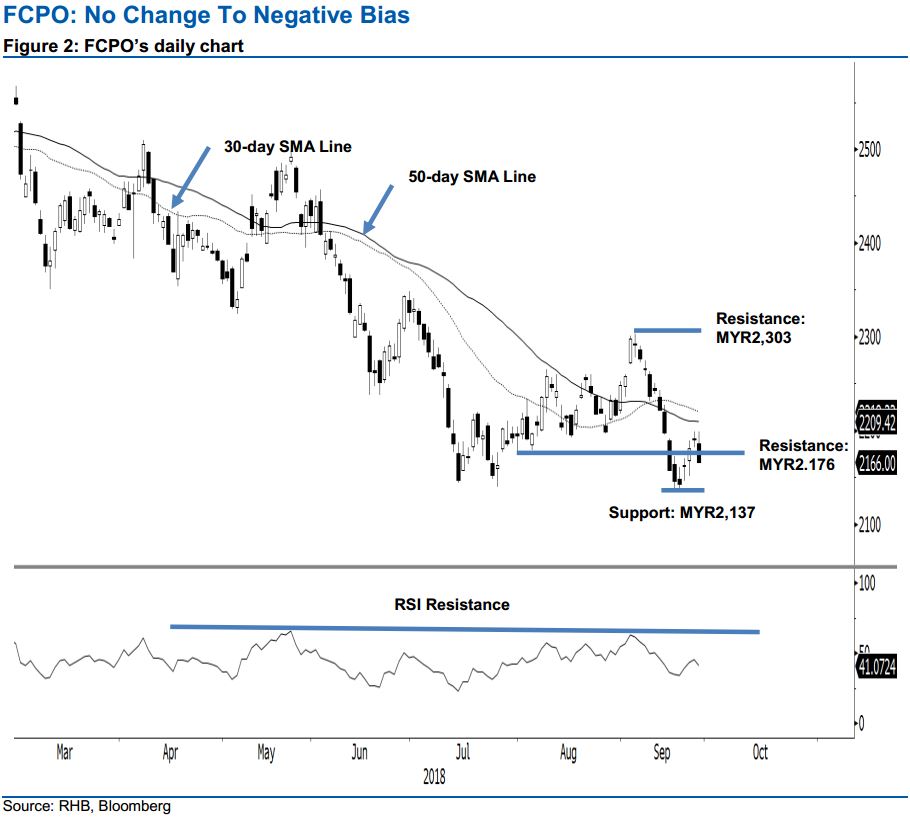

FCPO - No Change To Negative Bias

rhboskres

Publish date: Fri, 28 Sep 2018, 04:44 PM

Maintain short positions. The FCPO formed a black candle yesterday and, at the close, dropped back below the previous support of MYR2,176. It ended MYR24 lower at MYR2,166, after recording a low and high of MYR2,165 and MYR2,199. The negative session has paused the prior three sessions’ rebound. For the intraday, the commodity tested the prior session’s high of MYR2,199, before reversing into negative territory – indicating a possible price rejection at the said level. The commodity, currently trading below both the 30-day and 50-day SMA lines, is also pointing towards a negative bias. Overall, our near-term negative trading bias is still in place.

As there is no clear price signal to suggest a deeper rebound is ready to take place, we continue to recommend that traders remain in short positions. We initiated these positions at MYR2,222, the closing level of 14 Sep. To manage risks, trailing-stop t can be set at MYR2,199, the high of the latest two sessions.

Towards the downside, our immediate support is revised to MYR2,137, which is the low of 20 Sep. This is followed by MYR2,100. Overhead resistance is now at MYR2,176, the low of 31 Jul. This is followed by MYR2,303, the high of 5 Sep.

Source: RHB Securities Research - 28 Sept 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024