FKLI & FCPO - FKLI: No Change to the Positive Bias

rhboskres

Publish date: Thu, 04 Oct 2018, 04:38 PM

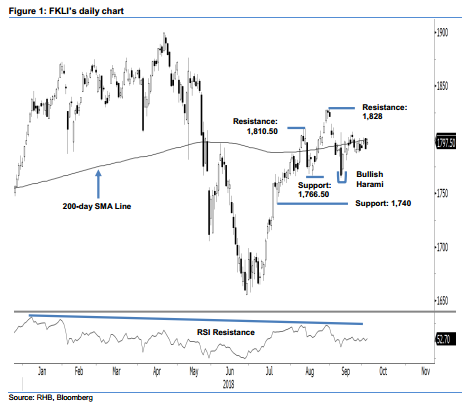

Maintain long positions. The FKLI closed positively in the latest session, ending 6 pts higher at 1,797.5 pts, while trading range was between 1,795.5 pts and 1,801 pts. Despite the positive closing, the index has still not been able to crack above the 200-day SMA line – current reading at 1,800 pts. It broadly implies that the index is still trapped within the consolidation zone that has been in development over the past two months. Should the bulls manage to break this level decisively, chances are high that the index could extend its upward trajectory. On this, we maintain our near-term positive trading bias.

As the bias is still skewed towards extending an upward move, we continue to suggest that traders remain in long positions. For risk management purposes, a stop-loss can be set below the 1,766.50-pt mark, in line with our long recommendation of 1,812 pts – also the closing level of 27 Aug.

The immediate support may be found at 1,766.5 pts, or 31 Jul’s low. The following support is at 1,740 pts, the low of 20 Jul. Towards the upside, the immediate resistance is at 1,810.5 pts, the highs of 9 and 10 Aug. This is followed by 1,828 pts, the high of 29 Aug.

Source: RHB Securities Research - 4 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024