E-mini Dow Futures - Rally Continues

rhboskres

Publish date: Thu, 04 Oct 2018, 04:47 PM

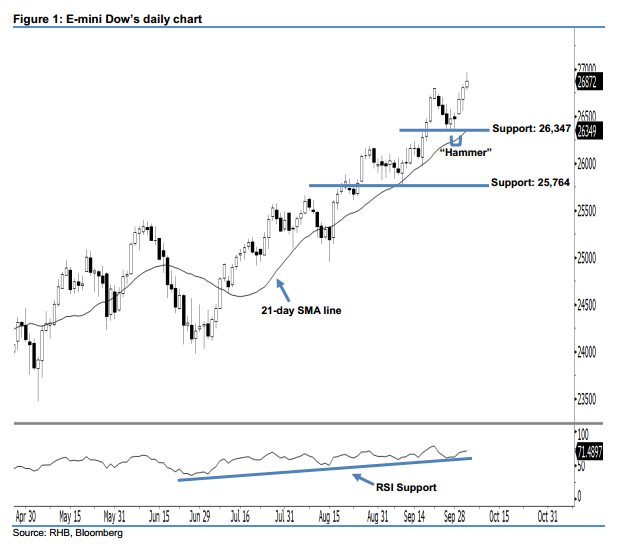

Bullish trend is likely to continue; stay long. Last night, the E-mini Dow’s upward momentum continued as expected, after it successfully ended higher to form another white candle. It gained 65 pts to close at 26,872 pts, after oscillating between a high of 26,966 pts and low of 26,776 pts. Market sentiment remains bullish in the near term, as the aforementioned white candle was its third in three consecutive days. As the E-mini Dow has recorded a new historical high, this is an indication that the rebound from 28 Sep’s “Hammer” pattern may persist.

Based on the daily chart, we maintain the immediate support at 26,347 pts, determined from the low of 28 Sep’s “Hammer” pattern. If a decisive breakdown arises, look to 25,764 pts – ie the previous low of 11 Sep – as the next support. On the other hand, the near-term resistance is seen at the 27,000-pt psychological mark. This is followed by the 27,500-pt round figure.

Hence, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 24,600-pt level on 11 Jul. A trailing stop can be set below the 26,347-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 4 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024