Hang Seng Index Futures - Weak Recovery

rhboskres

Publish date: Thu, 04 Oct 2018, 04:45 PM

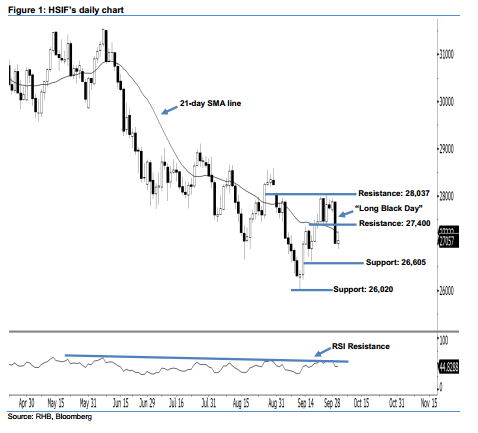

Stay short while setting a stop-loss above the 28,037-pt resistance. The HSIF formed a positive candle yesterday. It settled at 27,057 pts, after oscillating between a high of 27,252 pts and low of 26,871 pts. The emergence of yesterday’s positive candle merely indicates that sellers may be taking a pause after the previous session’s losses. Given that the index has continued to stay below the 21-day SMA line, this implies that the nearterm negative sentiment is still intact. Overall, we believe that the downside swing – which started from 2 Oct’s “Long Black Day” candle – may carry on.

As seen in the chart, we anticipate the immediate resistance at 27,400 pts, set near the midpoint of 2 Oct’s “Long Black Day” candle. If price climbs above this level, the next resistance is seen at 28,037 pts, defined from the high of 26 Sep. To the downside, we are eyeing the near-term support at 26,605 pts, obtained from the low of 18 Sep. This is followed by 26,020 pts – which was the previous low of 12 Sep.

Thus, we advise traders to stay short, since we had originally recommended initiating short below the 27,400-pt level on 3 Oct. In the meantime, a stop-loss is advisable above the 28,037-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 4 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024