FKLI - No Clear Price Rejection Yet

rhboskres

Publish date: Fri, 05 Oct 2018, 09:15 AM

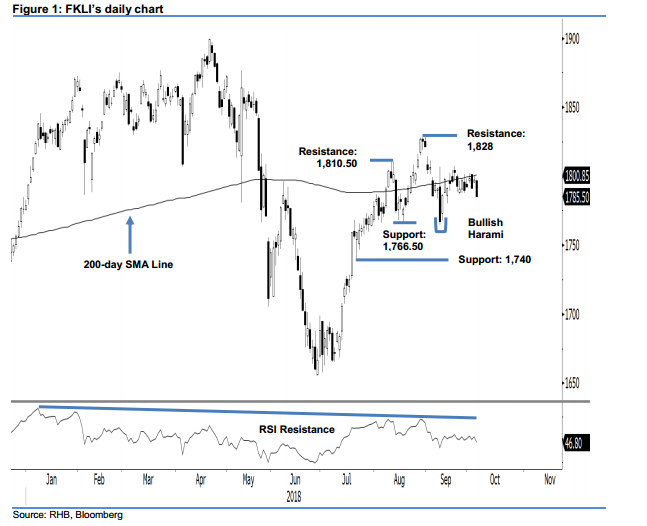

Maintain long positions as long as the immediate support is not breached. The FKLI formed a black candle yesterday. It shed 12 pts to close at 1,785.5 pts, which was also the session’s low. The intraday movement was also weak, as the index generally moved lower throughout the session, from a high of 1,797.5 pts. Nevertheless, the negative session has not produce a clear price rejection signal from the 200-day SMA line, where it now stands at 1,800 pts. Towards the downside, the risk of a deeper retracement may be present, should the immediate support of 1,766.5 pts be breached. Until this happens, we maintain our near-term positive trading bias.

Without a clear price signal to suggest the index is at risk of experiencing a deeper retracement, we continue to suggest that traders remain in long positions. To manage risks, a stop-loss can be set below the 1,766.50-pt mark, in line with our long recommendation of 1,812 pts – also the closing level of 27 Aug.

Towards the downside, immediate support may emerge at 1,766.5 pts, or 31 Jul’s low. The second support is at 1,740 pts, the low of 20 Jul. Conversely, the immediate resistance is at 1,810.5 pts, the highs of 9 and 10 Aug. This is followed by 1,828 pts, the high of 29 Aug.

Source: RHB Securities Research - 5 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024