WTI Crude Futures - Immediate Support: Under Pressure

rhboskres

Publish date: Mon, 08 Oct 2018, 09:39 AM

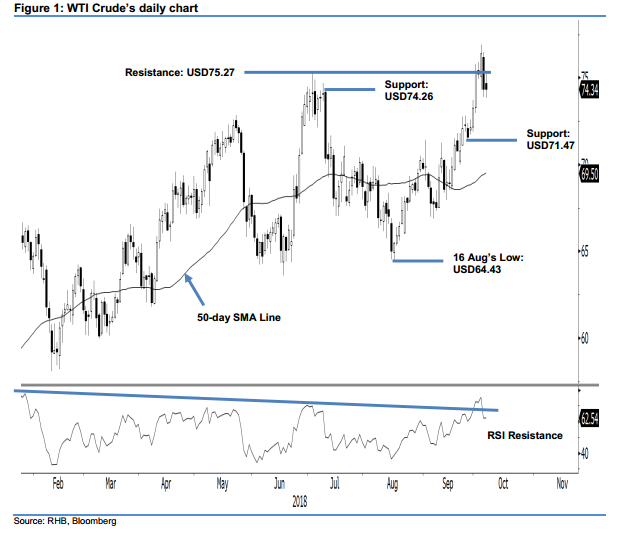

Maintain long positions. The WTI Crude ended the latest trading session in a neutral position after testing the USD74.26 immediate support. It crawled up USD0.01 to settle at USD74.34, while the session’s low and high stood at USD73.83 and USD75.22. We observed that the upward move from 18 Aug’s USD64.43 low remains in place, as we have yet to spot any clear price reversal signals. In the near term – provided said immediate support is not breached at the close – the risk for the commodity to experience a deeper consolidation is relatively low. Based on this, we maintain our near-term positive trading bias.

As no price exhaustion signals have been spotted yet, we maintain our recommendation that traders should keep to their long positions. Recall that we opened these positions at USD72.08, or 24 Sep’s closing level. For riskmanagement purposes, a trailing stop can be set at the USD74.26 threshold.

Immediate support is expected at USD74.26, or the high of 11 Jul. The second support is at USD71.47, which was the high of 26 Sep. Moving up, the immediate resistance is eyed at USD75.27, ie the high of 3 Jul. This is followed by the USD77.28 level, or the low of 28 Jun 2012

Source: RHB Securities Research - 8 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024