Hang Seng Index Futures - Downside Move Continues

rhboskres

Publish date: Mon, 08 Oct 2018, 09:41 AM

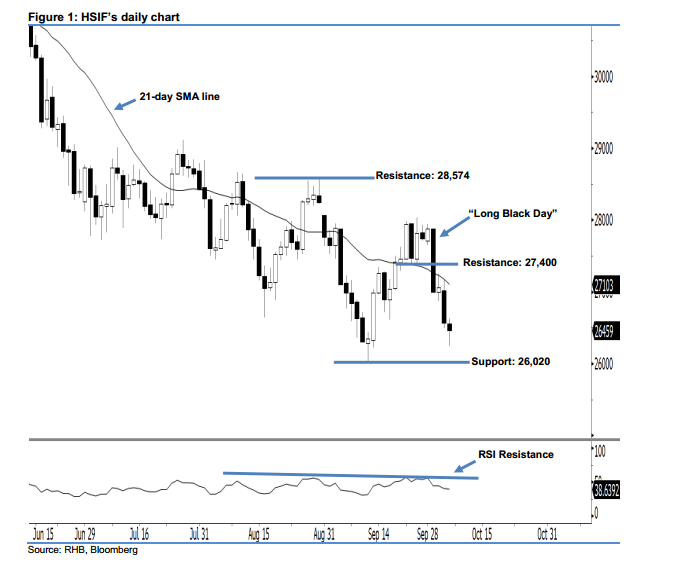

Downward momentum is likely to continue; stay short. The HSIF’s downside move has continued as expected, as the index ended lower last Friday. It closed at 26,459 pts, after oscillating between a high of 26,632 pts and low of 26,243 pts. On a technical basis, the HSIF has posted a second consecutive black candle below the declining 21-day SMA line. This indicates that the downside swing, which started from 2 Oct’s “Long Black Day” candle, may continue. Moreover, the 14-day RSI indicator deteriorated to a weaker reading of 38.63 pts, which implies that additional downward momentum may be present in coming sessions.

Presently, we anticipate the immediate resistance at 27,400 pts, set near the midpoint of 2 Oct’s “Long Black Day” candle. If the price climbs above this level, the next resistance is seen at 28,574 pts, which was the previous high of 30 Aug. On the other hand, the near-term support is seen at 26,020 pts, ie the previous low of 12 Sep. This is followed by the 26,000-pt psychological spot.

Thus, we advise traders to maintain short positions, given that we initially recommended initiating short below the 27,400-pt level on 3 Oct. A trailing-stop can be set above the 27,400-pt threshold as well in order to limit the risk per trade.

Source: RHB Securities Research - 8 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024