FCPO - Deeper Rebound Is Likely

rhboskres

Publish date: Mon, 08 Oct 2018, 09:44 AM

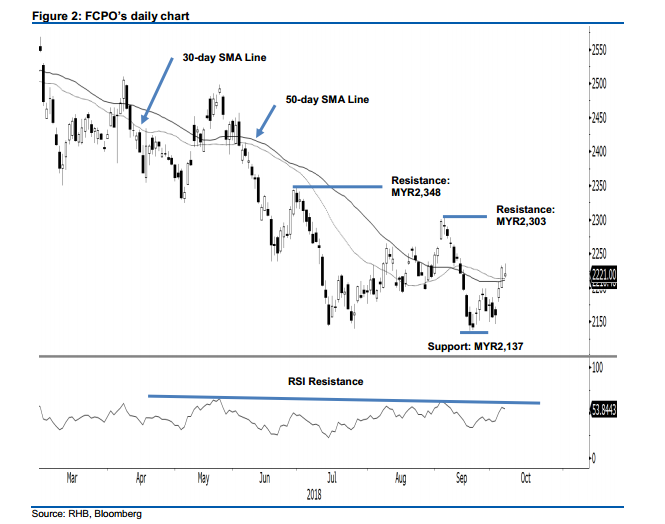

Maintain long positions while moving the trailing-stop to the breakeven point. The FCPO shed MYR9 to close at MYR2,221 last Friday, after trading sideways between MYR2,215 and MYR2,235. The weak session can be interpreted as the bulls taking a breather, after the strong rebound in the prior two sessions. This implies that the overall corrective rebound is still firmly in place. Further supporting this is the fact that the commodity is still trading above both the 30-day and 50-day SMA lines. Hence, we maintain our near-term positive trading bias.

As there are no price signals to suggest the corrective rebound has reached an end, we still recommend that traders keep to long positions. We initiated these at MYR2,199, the closing level of 3 Oct. For risk management purposes, a stop-loss can be placed at the breakeven level.

Towards the downside, the immediate support is maintained at MYR2,137, the low of 20 Sep. Breaking this may see the market test MYR2,100. Towards the upside, immediate resistance is set at MYR2,303, the high of 5 Sep. This is followed by MYR2,348, the high of 29 June.

Source: RHB Securities Research - 8 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024