FCPO - Possible Rejection From SMAs

rhboskres

Publish date: Tue, 09 Oct 2018, 09:21 AM

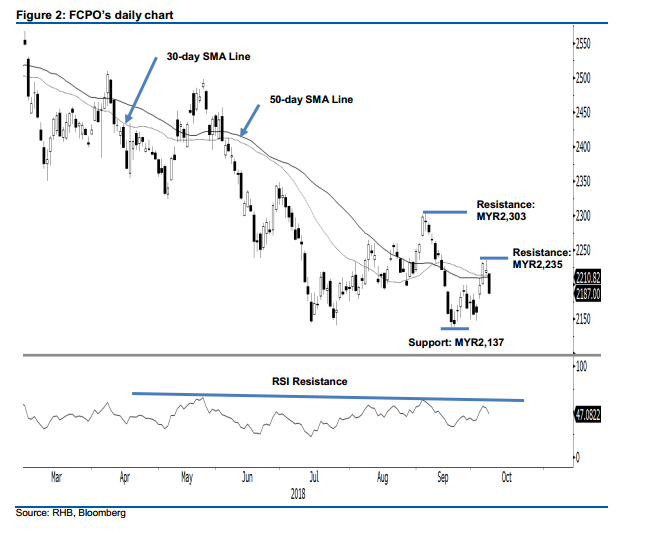

Initiate short positions as the bulls are being pushed back. The FCPO closed MYR34 weaker at MYR2,187 yesterday, near the session’s low of MYR2,185. The high was at MYR2,216. The weak closing sent the commodity to trade below both the 30-day and 50-day SMA lines. As such, there is a good likelihood that the commodity is experiencing a price rejection from these SMA lines. By extension, this could mean the corrective rebound that started from the low of MYR2,137 on 20 Sep may have ended. YTD, the commodity has been trending south, and the latest breakdown from these SMA lines have increased the chances of the downtrend resuming. Based on this, our near-term trading bias is now negative.

Our previous long positions – initiated at MYR2,199, the closing level of 3 Oct – were closed out at the breakeven mark in the latest session. On the bias that the YTD downtrend could be resumed, we initiate short positions at the latest closing. For risk management purposes, a stop-loss can be placed above MYR2,235.

We keep the immediate support at MYR2,137, the low of 20 Sep. This is followed by MYR2,100, a round figure. On the other hand, we revised the immediate resistance to MYR2,235, the high of 5 Oct. This is followed by MYR2,303, the high of 5 Sep.

Source: RHB Securities Research - 9 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024