E-mini Dow Futures - Stick to Long Positions

rhboskres

Publish date: Tue, 09 Oct 2018, 09:31 AM

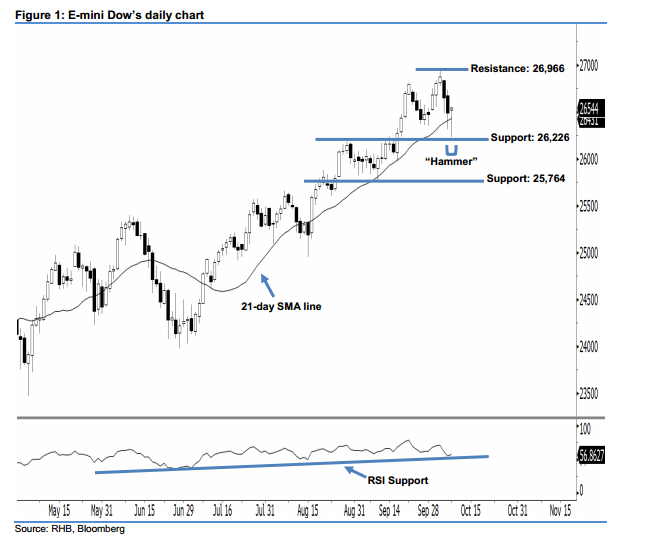

Stay long while setting a new trailing-stop below the 26,226-pt level. The E-mini Dow formed a positive candle with a long lower shadow last night. It gained 52 pts to close at 26,544 pts, off the session’s low of 26,226 pts. However, we maintain our near-term bullish sentiment, since yesterday’s candle did not close below the 26,347-pt support mentioned previously. Technically, the long lower shadow indicated there was initial selling momentum before the market recouped the intraday losses by the end of the trading session – reflecting that buyers still had control over the market.

Currently, we now eye the immediate support at 26,226 pts, which was determined from the low of 8 Oct’s “Hammer” pattern. The next support is seen at 25,764 pts, or the previous low of 11 Sep. Towards the upside, the near-term resistance is anticipated at the 26,966-pt record high. This is followed by the 27,000-pt psychological spot.

Consequently, we advise traders to maintain long positions following our recommendation to initiate long above the 24,600-pt level on 11 Jul. For now, a new trailing-stop set below the 26,226-pt threshold is advisable in order to secure part of the gains.

Source: RHB Securities Research - 9 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024