FCPO - Capping By The SMAs

rhboskres

Publish date: Wed, 10 Oct 2018, 04:28 PM

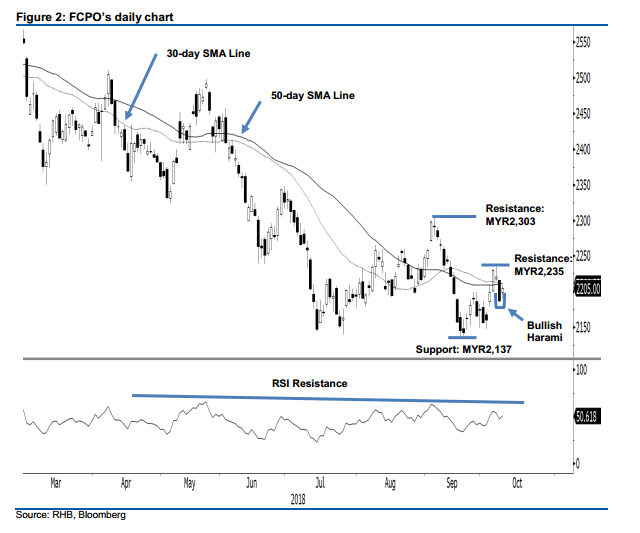

Maintain short positions. The FCPO formed a white candle in the latest session, as it gained MYR18 to close at MYR2,205. The session’s low and high were registered at MYR2,189 and MYR2,209. Despite the positive performance and the appearance of the “Bullish Harami” formation, the commodity is still capped by both the 30- day and 50-day SMA lines – the current reading is situated at around MYR2,211, indicating a negative bias. Based on the current technical landscape, as long as the commodity is not able to firmly crack above these SMA lines, the risk is still high of it resuming a YTD downtrend. Hence, we maintain our near-term negative trading bias.

With the risk of YTD retracement still high, we continue to recommend traders to keep to short positions. We initiated these positions at 8 Oct’s closing level of MYR2,187. For risk management purposes, a stop-loss can be placed above MYR2,235.

The immediate support is pegged at MYR2,137, the low of 20 Sep. Breaking this may see the market test MYR2,100, a round figure. The overhead resistance is set at to MYR2,235, the high of 5 Oct. This is followed by MYR2,303, the high of 5 Sep.

Source: RHB Securities Research - 10 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024