WTI Crude Futures - Looking Good

rhboskres

Publish date: Wed, 10 Oct 2018, 04:29 PM

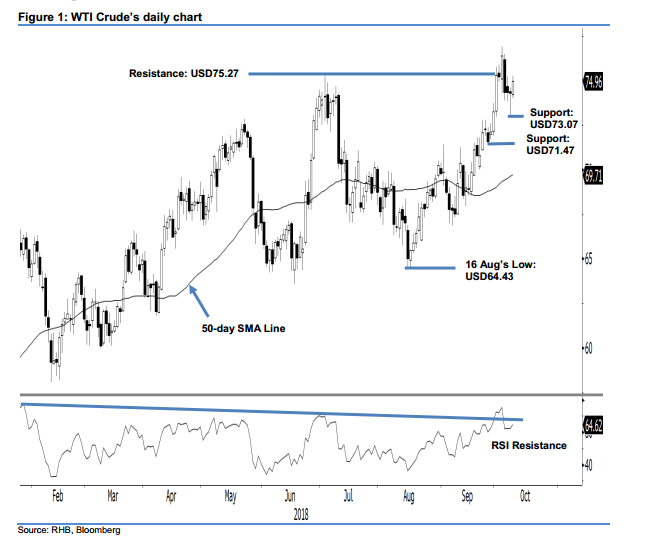

Maintain long positions. The WTI Crude formed a white candle in the latest session. The session’s low and high was at USD74 and USD75.28, before the commodity ended at USD74.96 – indicating a USD0.67 gain. The latest positive session implied there was a positive follow-through from the previous session’s “Hammer” candlestick – this suggests chances are high that the WTI Crude is resuming its positive price trajectory. The 50-day SMA line – which continues to edge higher – is lending further support to this positive bias. On these observations, we keep to our near-term positive trading bias.

As the probability is still tilted towards an extension of the upward move, we maintain our recommendation for traders to maintain their long positions. Recall that we opened these positions at USD72.08, or 24 Sep’s closing level. For risk-management purposes, a trailing stop can be set at USD73.07.

The immediate support is revised to USD73.07, the low of 8 Oct’s “Hammer” formation. This is followed by the USD71.47 level, which was the low of 26 Sep. Moving up, the immediate resistance is now eyed at USD75.27, ie the high of 3 Jul. The following resistance is at the USD77.28 level, or the low of 28 Jun 2012.

Source: RHB Securities Research - 10 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024