COMEX Gold - No Clear Signals for a Bounce

rhboskres

Publish date: Wed, 10 Oct 2018, 04:30 PM

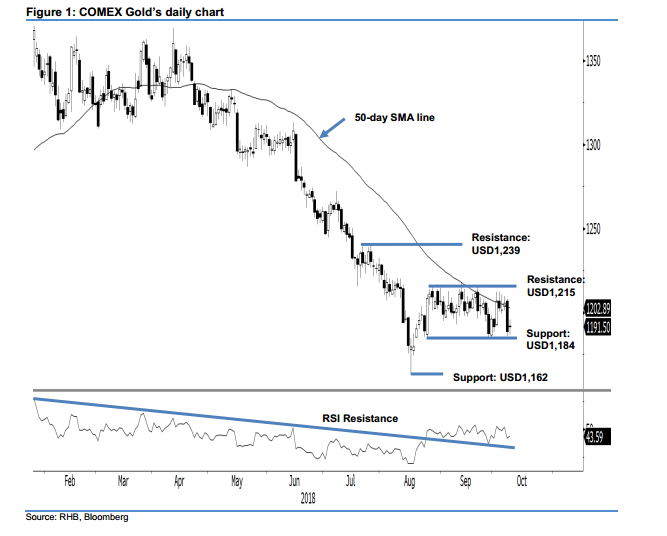

Maintain long positions. The COMEX Gold’s latest session can be seen as neutral. It ended USD1 higher after having traded in a directionless range between USD1,186.60 and USD1,195.80 – suggesting neither bulls nor bears were in control. The neutral session came after the commodity slid from the resistance zone – which consists of the 50-day SMA line and USD1,215 immediate resistance – in the prior session. While there are still no price actions to suggest the bulls are re-emerging from the current level – which is near the USD1,184 immediate support – the near-term positive bias should remain in place, provided this support is not invalidated.

With the aforementioned immediate support still holding ground, we continue to advise traders to keep their long positions. Recall that we initiated these positions after the precious metal breached above the USD1,207.60 mark on 12 Sep. For risk-management purposes, a stop-loss can be set below the USD1,184 threshold.

The immediate support is pegged at USD1,184, which was the low of 24 Aug. The is followed by the USD1,162 critical support registered on 16 Aug – this was also the YTD low. The overhead resistance is set at the USD1,215 mark, or 20 Jul’s low. This is followed by the USD1,239 level, which was 26 Jul’s high.

Source: RHB Securities Research - 10 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024