FKLI & FCPO - FKLI: Bears Gain Control

rhboskres

Publish date: Thu, 11 Oct 2018, 04:24 PM

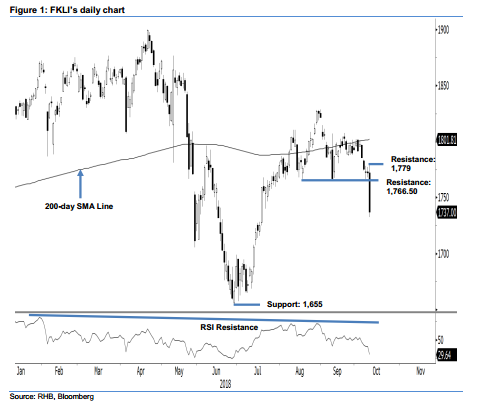

Initiate short positions as price rejection from the 200-day SMA line is confirmed. The FKLI formed a black candle in the latest trading. At the closing, it decisively pierced through the previous support marks of 1,766.5 pts and 1,740 pts. The intraday tone was negative, as the index slid lower throughout the session, from a high of 1,779 pts to a low of 1,732.5 pts, before ended 35 pts lower at 1,737 pts. As mentioned, a firm breach of the said previous support mark of 1,766.5 pts is likely to confirm a price rejection from the 200-day SMA line. This means, the index’s upward move since the low of end-June has likely reached its end – chances are high that the index may now develop a deeper retracement. Based on these, we switch our near-term trading bias to negative.

Our previous long positions initiated at 1,812 pts, or the closing level of 27 Aug were closed out yesterday at 1,766.5 pts. On the rising risk that the index may develop a deeper retracement, we open short positions at yesterday’s closing. For risk management purposes, a stop loss can be placed at above 1,779 pts.

The immediate support is revised to 1,700 pts, a round figure. This is followed by 1,655 pts, which was the low of 28 June. Moving up, the immediate resistance is eyed at 1,766.5 pts, or 31 Jul’s low. This is followed by 1,779 pts – the latest session’s high.

Source: RHB Securities Research - 11 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024