Hang Seng Index Futures - Weak Recovery

rhboskres

Publish date: Thu, 11 Oct 2018, 04:26 PM

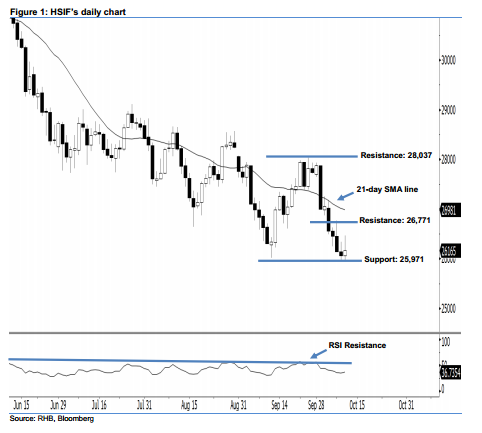

Stay short, with a trailing-stop set above the 26,771-pt resistance. The HSIF formed a positive candle with a long upper shadow yesterday. During the intraday session, it rose to a high of 26,470 pts before ending at 26,165 pts for the day. We note that the index is still trading below the declining 21-day SMA line, which signals that the near-term bearish sentiment remains intact. The long upper shadow implies that there was initial buying momentum during the day before the market moved down by the end of the trading session – reflecting that the sellers should still have control over the market. Overall, we keep our bearish view on our near-term outlook.

As shown in the chart, we are eyeing the immediate resistance level at 26,771 pts, ie the high of 8 Oct. If the price climbs above this level, look to 28,037 pts – which was the previous high of 26 Sep – as the next resistance. On the other hand, the immediate support level is maintained at 25,971 pts, ie the low of 9 Oct. If a decisive breakdown arises, the next support is seen at the 25,000-pt psychological mark.

Therefore, we advise traders to stay short, following our recommendation of initiating short below the 27,400-pt level on 3 Oct. In the meantime, a trailing-stop can be set above the 26,771-pt threshold in order to lock in part of the profits.

Source: RHB Securities Research - 11 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024