WTI Crude Futures - Bears Exerting Pressure Again

rhboskres

Publish date: Thu, 11 Oct 2018, 04:26 PM

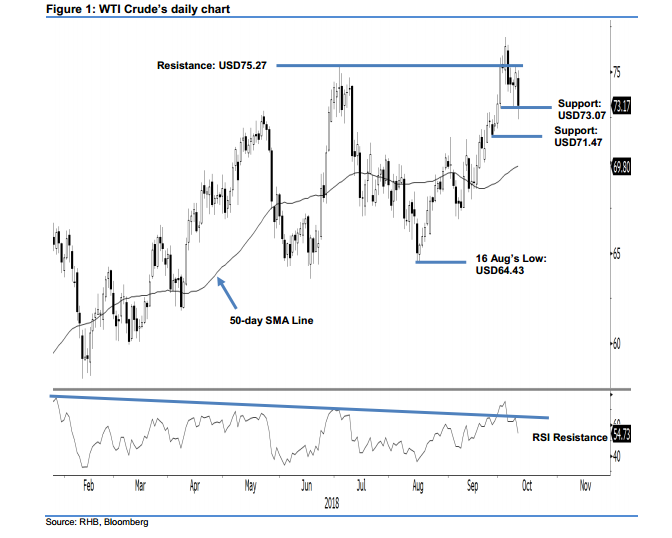

Maintain long positions provided immediate support is not broken. The WTI Crude formed a black candle in the latest session, as the bears tested the immediate support of USD73.07. Intraday tone was negative - the commodity moved lower throughout the session, from a high of USD75.08 to a low of USD72.38, before settling USD1.79 lower at USD73.17. The recent sessions’ weak performances are suggesting that there is an increased chance for price rejection from the immediate resistance of USD75.27 – which the commodity managed to breach but subsequently retreated. For this possible price rejection to be confirmed, the said immediate support needs to be breached firmly. Until this happens, we keep to our near-term positive trading bias.

As there is no price signal to suggest that a deeper retracement is in the process of developing, we maintain our recommendation for traders to keep their long positions. Recall that we opened these positions at USD72.08, or 24 Sep’s closing level. For risk management purposes, a trailing stop can be set at USD73.07.

Immediate support is kept at USD73.07, the low of 8 Oct. The second support is at USD71.47, which was the low of 26 Sep. Overhead resistance is set at USD75.27, ie the high of 3 Jul. The following resistance is at the USD77.28 level, or the low of 28 Jun 2012.

Source: RHB Securities Research - 11 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024