WTI Crude Futures - Deeper Retracement May be Developing

rhboskres

Publish date: Fri, 12 Oct 2018, 04:17 PM

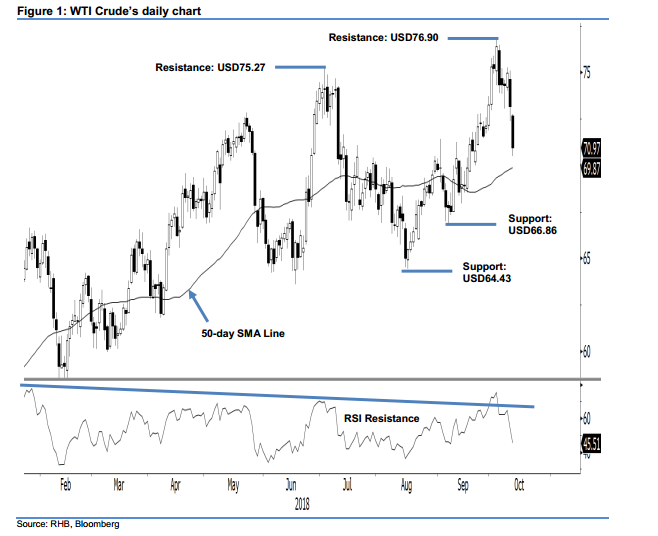

Initiate short positions as the bears are gaining ground. The WTI Crude performed weakly in the latest trading session, forming a black candle which at the closing breached the previous immediate support of USD73.07. The session’s low and high were posted at USD70.51 and USD72.76, before it ended at USD70.97, indicating a decline of USD2.20. The breakdown from the said previous immediate support, in our view, confirmed that the commodity is being rejected from the USD75.27 resistance mark. This implies that the commodity is likely to develop some form of correction pattern – with the bias to retrace further. Based on this, we switch our nearterm trading bias to negative..

Our previous long positions opened at USD72.08, or 24 Sep’s closing level, which were closed out yesterday at USD73.07. On the bias that the commodity may see a deeper retracement, we initiate short positions at the latest closing. For risk management purposes, a stop loss can be placed at above USD76.90.

Immediate support is revised to USD66.86, which was the low of 7 Sep. This is followed by USD64.43, the low of 16 Aug. Immediate resistance is now set at USD75.27, ie the high of 3 Jul. This is followed by USD76.90, or the high of 3 Oct.

Source: RHB Securities Research - 12 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024