Hang Seng Index Futures - Stick to Short Positions

rhboskres

Publish date: Mon, 15 Oct 2018, 09:12 AM

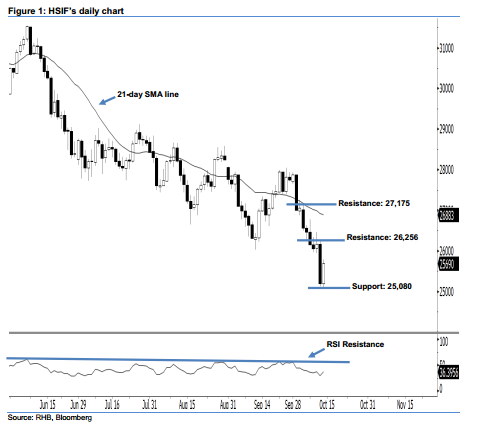

Stay short, with a new trailing-stop set above the 26,256-pt level. The HSIF formed a white candle last Friday. It settled at 25,690 pts, off its high of 25,788 pts and low of 25,080 pts. However, we believe the near-term downside move is not over yet, as the index recently breached below the 26,000-pt threshold. Last Friday’s white candle can merely be illustrated as a technical rebound after the recent losses, in our view. Technically, the bearish sentiment remains intact as long as the HSIF does not recoup the losses from 11 Oct’s long black candle. Overall, the near-term market trend remains bearish.

Judging from the current outlook, the immediate resistance level is now anticipated at 26,256 pts, ie the high of 11 Oct’s long black candle. The next resistance is seen at 27,175 pts, which was the high of 4 Oct. Towards the downside, we are now eyeing the near-term support level at 25,080 pts, determined from the previous low of 12 Oct. This is followed by the 25,000-pt psychological spot.

To re-cap, on 3 Oct, we initially recommended traders to initiate short positions below the 27,400-pt level. We continue to advise them to stay short for now, while setting a new trailing-stop above the 26,256-pt threshold. This is in order to lock in a larger part of the profits.

Source: RHB Securities Research - 15 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024