E-mini Dow Futures - Bearish Outlook Stays Intact

rhboskres

Publish date: Tue, 16 Oct 2018, 09:07 AM

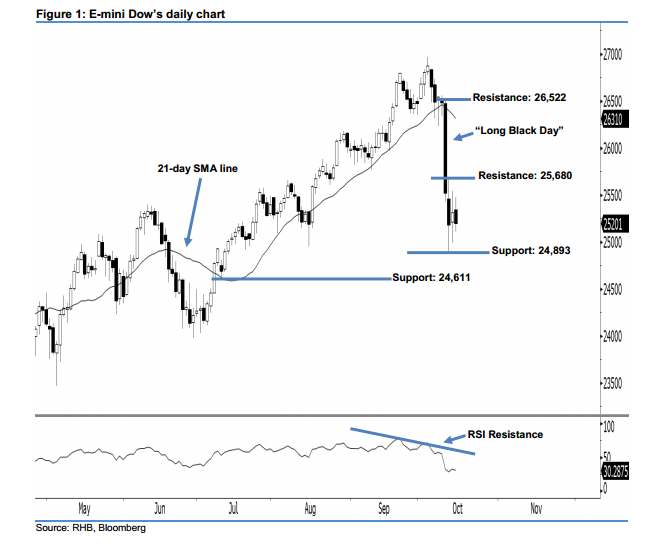

Maintain short positions. Selling momentum in the E-mini Dow continued as expected, as a black candle was formed last night. This points to a continuation of the downside move. The index lost 115 pts to close at 25,201 pts, off the session’s high of 25,471 pts and low of 25,111 pts. From a technical perspective, yesterday’s candle has erased the previous day’s gains and marked a lower close below the 21-day SMA line. This indicates that the downward momentum has extended. Overall, we expect further downside for the market if the E-mini Dow continues staying below the 25,680-pt resistance in the coming sessions.

According to the daily chart, the immediate resistance level is seen at 25,680 pts, ie the high of 11 Oct. The next resistance would likely be at 26,522 pts, set at the high of 10 Oct’s “Long Black Day” candle. On the other hand, we maintain the immediate support level at 24,893 pts, which was the previous low of 11 Oct. If the price breaks down, look to 24,611 pts – which was the previous low of 11 Jul – as the next support.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 26,000-pt level on 11 Oct. In the meantime, a trailing-stop is preferably set above the 25,680-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 16 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024