FKLI & FCPO - FKLI: Immediate Resistance Holding Up

rhboskres

Publish date: Tue, 16 Oct 2018, 09:13 AM

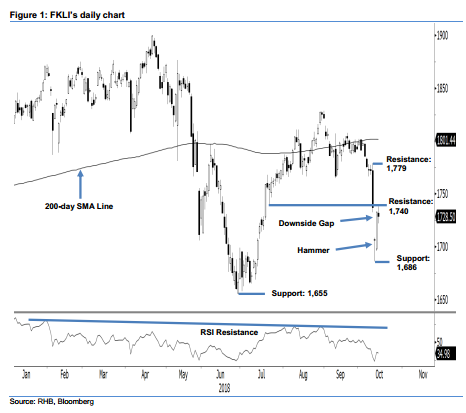

Maintain short positions; bulls still limiting immediate resistance. The FKLI closed marginally lower yesterday, easing 4.5 pts to settle at 1,728.5 pts. The day’s low and high were at 1,722 pts and 1,738 pts. As mentioned in our previous report, its overall near-term trading landscape would still be negative, despite the strong rebound in the prior two sessions – as this was deemed as a sign of consolidation after the recent sharp declines. For this outlook to change to positive, the said immediate resistance has to be taken out decisively by the bulls. Until this happens, we maintain our negative trading bias.

In the absence of price signals showing that the negative bias has ended, we continue to recommend that traders keep to short positions – which we initiated at 1,737 pts, 10 Oct’s closing level. For risk management purposes, a stop loss can be placed above 1,779 pts.

Towards the downside, immediate support is pegged at 1,686 pts, the low of 11 Oct. This is followed by 1,655 pts, the low of 28 June. Conversely, the immediate resistance is at 1,740 pts, or 20 Jul’s low. This is followed by 1,779 pts – the high of 10 Oct.

Source: RHB Securities Research - 16 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024