WTI Crude Futures - Still Consolidating Around Uptrend Line

rhboskres

Publish date: Wed, 17 Oct 2018, 05:23 PM

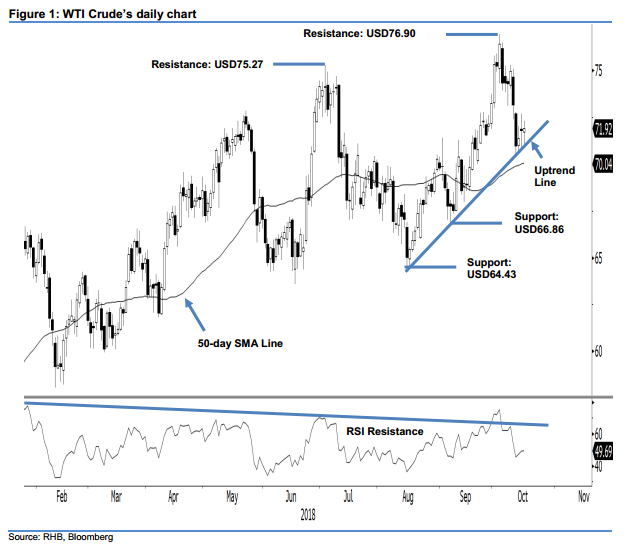

Maintain short positions as the negative price trend is not showing signs of reversing. The WTI Crude ended the latest session slightly better. For the intraday, the commodity experienced a directionless sideway trading – which saw it ranging between USD71.02 and USD72.29, before it ended at USD71.92, indicating a gain of USD0.14. Still, the price action over the latest three sessions around the uptrend line – as drawn in the chart – can be seen as a consolidation phase after the commodity experienced a relative sharp decline recently. Should the said uptrend line be broken, the downward move will likely resume. Hence, we are keeping our negative trading bias.

As we are not seeing price signals that suggest the weak bias has reached an end, we continue to recommend that traders keep to short positions. We initiated short positions at USD70.97, which was the closing level of 11 Oct. For risk management purposes, a stop-loss can be placed at above USD76.90.

We maintain the immediate support at USD66.86, which was the low of 7 Sep. This is followed by USD64.43, the low of 16 Aug. On the other hand, the immediate resistance is now at USD75.27, ie the high of 3 Jul. This is followed by USD76.90, or the high of 3 Oct.

Source: RHB Securities Research - 17 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024