E-mini Dow Futures - Triggers Long Positions

rhboskres

Publish date: Wed, 17 Oct 2018, 05:26 PM

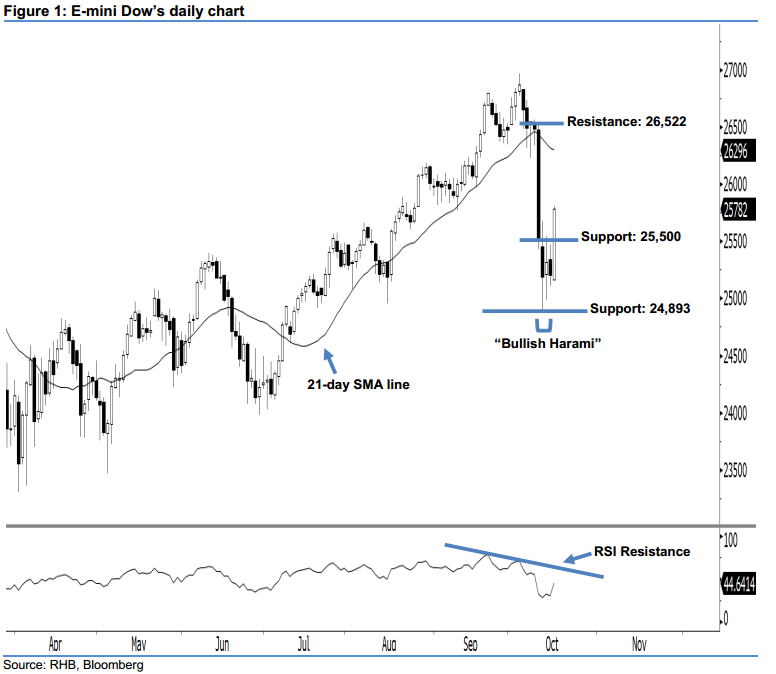

Initiate long positions above the 25,500-pt level. The E-mini Dow formed a long white candle yesterday, implying that momentum of buying could be strong. It surged 581 pts to settle at 25,782 pts, off the session’s low of 25,166 pts. As the index has recouped the previous three sessions’ losses and closed above the 25,680-pt resistance mentioned previously, this suggests that market sentiment is turning positive. Yesterday’s long white candle can be viewed as a confirmation of the bulls extending the rebound from 12 Oct’s “Bullish Harami” pattern. Yesterday’s closing also triggered our trailing-stop, which we had previously recommended at the 25,680-pt level.

As seen in the chart, we are now eyeing the immediate support level at 25,500 pts, situated near the midpoint of 16 Oct’s long white candle. Meanwhile, the crucial support is seen at 24,893 pts, obtained from the low of 12 Oct’s “Bullish Harami” pattern. Towards the upside, the near-term resistance level is anticipated at the 26,000-pt psychological spot. This is followed by 26,522 pts, ie the high of 10 Oct’s long black candle.

Hence, we advise traders to initiate fresh long positions above the 25,500-pt level. A stop-loss can be set below the 24,893-pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 17 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024