E-mini Dow Futures - Rebound Remains Intact

rhboskres

Publish date: Thu, 18 Oct 2018, 04:15 PM

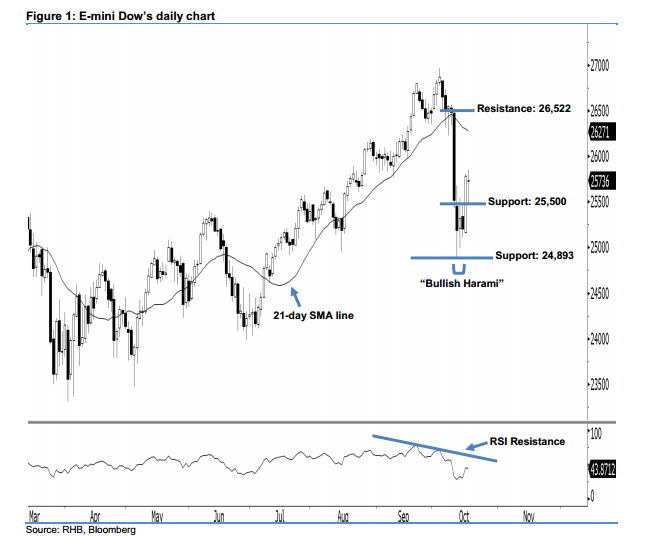

Stay long, with a stop-loss set below the 24,893-pt support. The E-mini Dow formed a “Doji” candle yesterday. It settled at 25,736 pts, after hovering between a high of 25,845 pts and low of 25,461 pts throughout the day. However, we think the buying momentum is not diminished thus far, as the index continues to remain above the recent low of the 24,893-pt support mentioned previously. Technically speaking, as long as the E-mini Dow does not negate the bullishness of 12 Oct’s “Bullish Harami” pattern, there is a possibility that the rebound will continue. Presently, we remain positive on the E-mini Dow’s outlook.

Based on the daily chart, the immediate support level is seen at 25,500 pts, set near the midpoint of 16 Oct’s long white candle. The next support is maintained at 24,893 pts, ie the low of 12 Oct’s “Bullish Harami” pattern. To the upside, we anticipate the near-term resistance level at the 26,000-pt psychological mark. This is followed by 26,522 pts, defined from the high of 10 Oct’s long black candle.

Therefore, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 25,500-pt level on 17 Oct. In the meantime, a stop-loss can be set below the 24,893-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 18 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024