Hang Seng Index Futures - Taking a Breather

rhboskres

Publish date: Fri, 19 Oct 2018, 04:21 PM

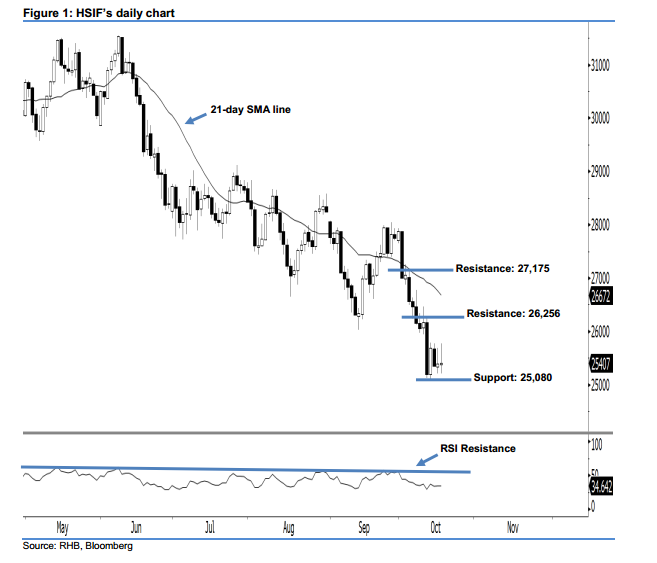

Maintain short positions while setting a trailing-stop above the 26,256-pt resistance. The HSIF ended on another “Doji” candle yesterday. It closed at 25,407 pts, after oscillating between a high of 25,775 pts and low of 25,211 pts. Yet, we maintain our bearish sentiment, as the index is still trading below the declining 21-day SMA line. As losses from 11 Oct’s long black candle has not been recouped, this shows that the downside move stays intact. Overall, we remain bearish on the HSIF’s outlook.

Based on the daily chart, we maintain the immediate resistance at 26,256 pts, which was the high of 11 Oct’s long black candle. If the price breaks above this level, look to 27,175 pts – ie the high of 4 Oct – as the next resistance. Towards the downside, the near-term support is seen at 25,080 pts, obtained from the previous low of 12 Oct. This is followed by the 25,000-pt psychological mark.

Hence, we advise traders to maintain short positions, given that we initially recommended initiating short below the 27,400-pt level on 3 Oct. Meanwhile, a trailing-stop can be set above the 26,256-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 19 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024