E-mini Dow Futures - Stick to Long Positions

rhboskres

Publish date: Fri, 19 Oct 2018, 04:22 PM

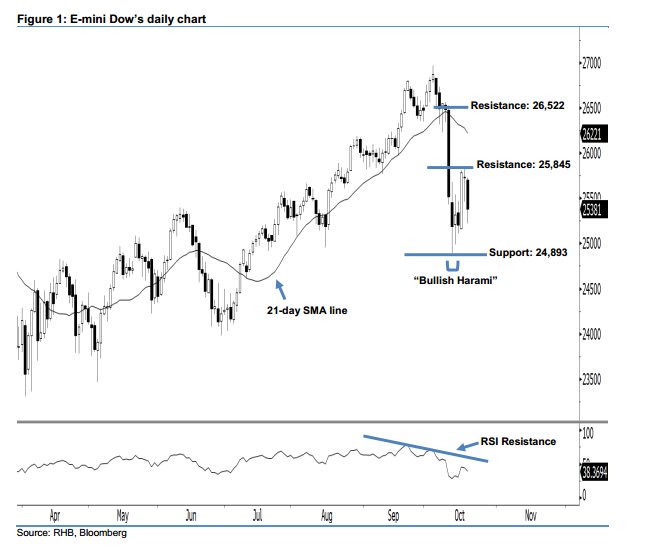

Rebound is not over yet; stay long. The E-mini Dow ended lower to form a black candle last night. It lost 355 pts to close at 25,381 pts, off its high of 25,726 pts and low of 25,217 pts. Still, on a technical basis, yesterday’s black candle can be viewed as a pullback after the recent gains. We believe the bulls may continue to control the market, given that the index did not negate the bullishness of 12 Oct’s “Bullish Harami” pattern. Overall, we keep our bullish view on the E-mini Dow’s outlook.

Presently, we are eyeing the immediate support at the 25,000-pt psychological spot. If the price breaks down, the crucial support is seen at 24,893 pts, determined from the low of 12 Oct’s “Bullish Harami” pattern. Towards the upside, the immediate resistance is anticipated at 25,845 pts, ie the high of 17 Oct. The next resistance would likely be at 26,522 pts, situated at the high of 10 Oct’s long black candle.

Thus, we advise traders to stay long, following our recommendation to initiate long above the 25,500-pt level on 17 Oct. A stop-loss can be set below the 24,893-pt threshold in order to limit downside risk.

Source: RHB Securities Research - 19 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024