WTI Crude Futures - Minor Pushback From the Bulls

rhboskres

Publish date: Mon, 22 Oct 2018, 02:52 PM

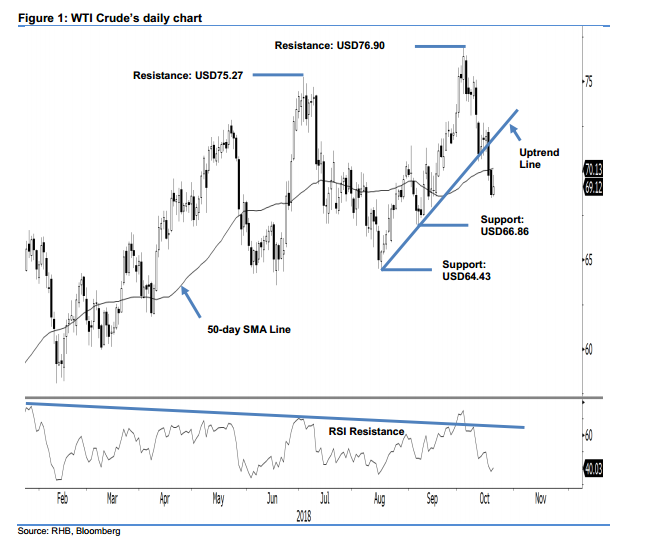

Maintain short positions. The WTI Crude formed a white candle in the latest trading session to end at USD69.12, indicating a gain of USD0.47. The session’s low and high were recorded at USD68.56 and USD69.77. The positive session can be seen as a sign that bears are taking a breather after the recent sharp retracement – which saw the 50-day SMA line broken in the prior session. For now, as long as the commodity is not able to recapture the said SMA line, chances for it to develop a deeper rebound or posing a total price reversal would still be low. Hence, we are keeping our negative trading bias.

As the commodity’s overall negative bias is not showing sign of ending, we continue to recommend that traders keep to short positions. We initiated short positions at USD70.97, which was the closing level of 11 Oct. For risk management purposes, a stop-loss can be placed at the breakeven level.

Towards the downside, immediate support is set at USD66.86, which was the low of 7 Sep. The second support is at USD64.43, the low of 16 Aug. Moving up, the immediate resistance is now at USD75.27, ie the high of 3 Jul. This is followed by USD76.90, or the high of 3 Oct.

Source: RHB Securities Research - 22 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024