FCPO - Bulls On The Defensive

rhboskres

Publish date: Mon, 22 Oct 2018, 03:07 PM

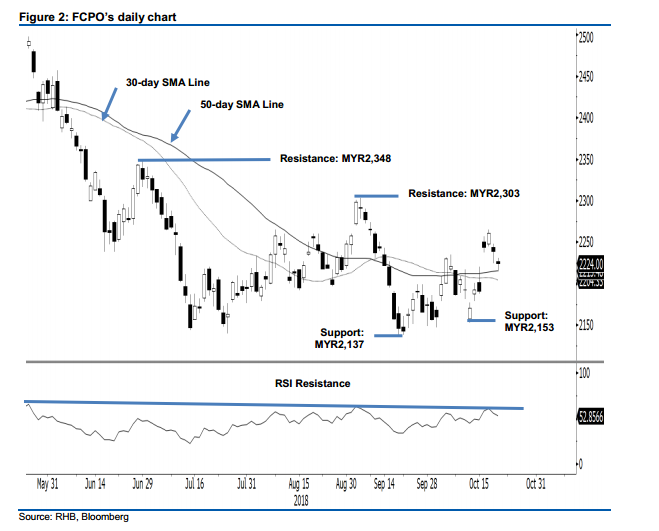

Maintain long positions as no confirmation for YTD negative trend returning. The FCPO ended the latest session weaker by MYR15 to settle at MYR2,224 – indicating the bears were in the control. The session’s low and high were recorded at MYR2,215 and MYR2,231. Despite the weak closing, the commodity’s 30-day and 50-day SMA lines have yet to be breached. This implies that the risk for the YTD declining price trend to return is low at the moment. Provided the immediate support of MYR2,153 is not broken, the bias for the commodity to extend its rebound would still be valid. Hence, we maintain our positive trading bias.

As the rebound is still not showing signs of ending, we continue to recommend traders keep to long positions. To recap, we initiate these positions at MYR2,244, or the closing level of 16 Oct. For risk management purposes, a stop-loss can be placed below MYR2,153.

The immediate support is set at MYR2,153, the low of 11 Oct. Breaking this may see the bears test MYR2,137, the low of 20 Sep. Conversely, the immediate resistance is set at MYR2,303, the high of 5 Sep. This is followed by MYR2,348, the high of 29 Jun.

Source: RHB Securities Research - 22 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024