Hang Seng Index Futures - Outlook Remains Negative

rhboskres

Publish date: Tue, 23 Oct 2018, 02:48 PM

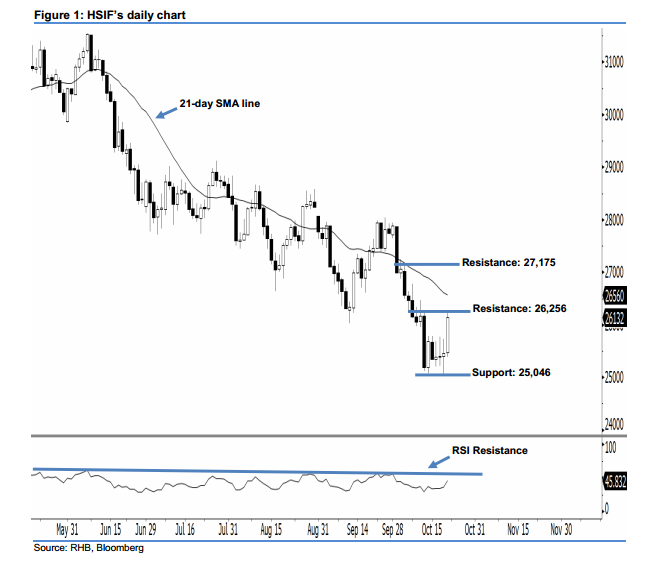

Stay short, provided the 26,256-pt resistance is not violated at the close. The HSIF ended higher to form a white candle yesterday. It rose to a high of 26,222 pts during the intraday session before ending at 26,132 pts for the day. Technically, yesterday’s white candle should be viewed as a technical rebound following the recent losses seen over the last three weeks. We think the bears may continue to control the market, as long as the HSIF does not recoup the losses from 11 Oct’s long black candle. Overall, we remain negative in our outlook.

Based on the daily chart, the immediate resistance is maintained at 26,256 pts – this was determined from the high of 11 Oct’s long black candle. If the price breaks above this level, look to 27,175 pts, which was the high of 4 Oct, as the next resistance. Towards the downside, the near-term support is seen at 25,046 pts, ie the previous low of 19 Oct. This is followed by the 25,000-pt psychological mark.

We advise traders to maintain short positions, since we originally recommended they initiate short below the 27,400-pt level on 3 Oct. In the meantime, a trailing-stop can be set above the 26,256-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 23 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024