COMEX Gold - Consolidation Phase Is Extending

rhboskres

Publish date: Tue, 23 Oct 2018, 02:51 PM

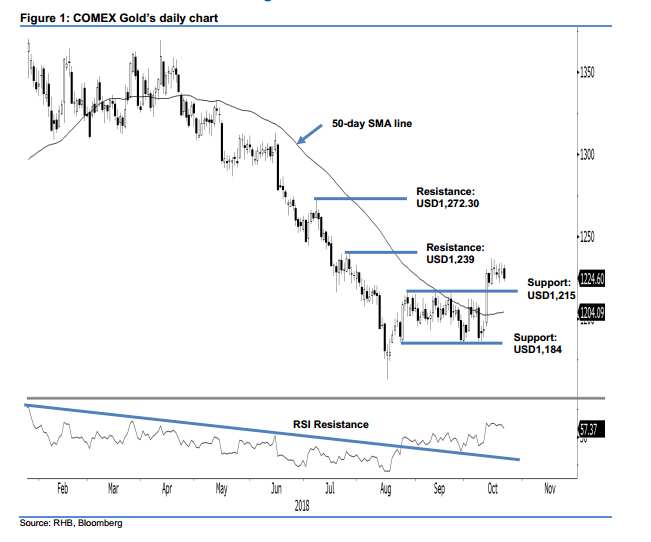

Maintain long positions as the overall technical picture is still constructive. The COMEX Gold ended the latest session on a negative note. Intraday, the commodity generally slid lower from a high of USD1,232.50 to a low of USD1,222.80, before settling at USD1,224.60, indicating a decline of USD4.10. The negative session did not alter the commodity’s overall positive technical picture. From our observation, the commodity is extending its consolidation mode above the USD1,215 immediate support mark. This consolidation phase is considered healthy, especially after the recent sharp upward move. Once this consolidation phase is finished, chances are high the commodity would extend its upward move. Hence, we are keeping our positive trading bias.

As the overall bias for the commodity to extend its upward move is still in pace, we continue to advise traders to keep their long positions. Recall that we initiated these positions after the precious metal breached above the USD1,207.60 mark on 12 Sep. For risk management purposes, a stop-loss can be placed below USD1,215.

Immediate support is pegged at the USD1,215 mark, or 20 Jul’s low. The second support is at USD1,184, which was the low of 24 Aug. Moving up, the immediate resistance is eyed at the USD1,239 level, which was 26 Jul’s high. This is followed by USD1,272.30, the high of 9 Jul.

Source: RHB Securities Research - 23 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024