FKLI - Bears Are in Control

rhboskres

Publish date: Tue, 23 Oct 2018, 02:56 PM

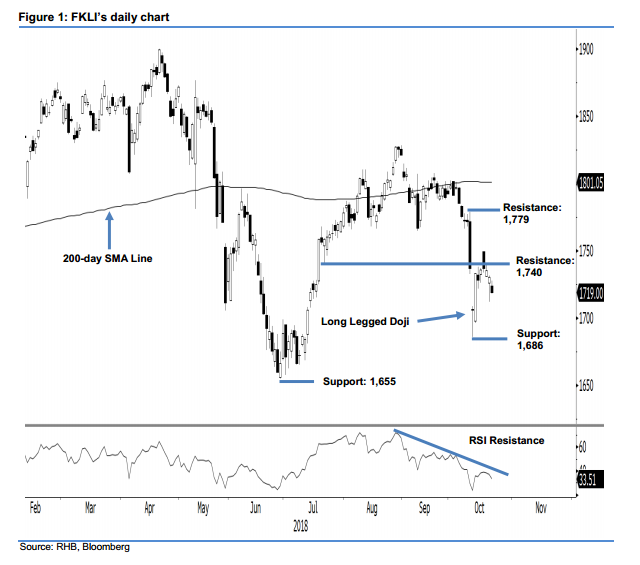

Maintain short positions as the bearish bias continues to develop. The FKLI posted a low and high of 1,718 pts and 1728 pts, before ending at 1,719 pts – indicating a decline 11.5 pts. The weak session suggests the weak price trend, which started after a price rejection from the 200-day SMA line, is still developing. For now, as long as the immediate resistance of 1,740 pts is not breached upwards decisively, the negative bias will likely be extended. Hence, we maintain our negative trading bias.

As the bears are still in control, we continue to recommend that traders keep to short positions – which we initiated at 1,737 pts, or 10 Oct’s closing level. To manage risks, a stop loss can be placed above 1,779 pts.

The immediate support remains at 1,686 pts, the low of 11 Oct. The second support is at the 1,655-pt level, the low of 28 June. Moving up, the immediate resistance is at 1,740 pts, or 20 Jul’s low. This is followed by 1,779 pts – the latest session’s high.

Source: RHB Securities Research - 23 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024