E-mini Dow Futures - Rebound Is Not Over Yet

rhboskres

Publish date: Wed, 24 Oct 2018, 04:30 PM

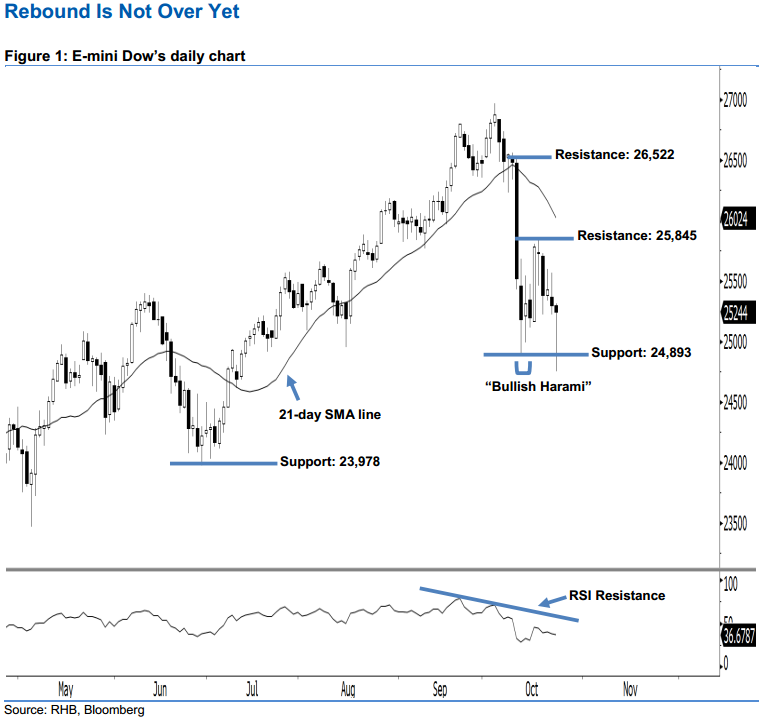

Rebound is not diminished yet; maintain long positions. The E-mini Dow formed a negative candle with a long lower shadow yesterday. It plunged to a low of 24,750 pts during the intraday session, before ending at 25,244 pts for the day. On a technical basis, we note that the index failed to close below the 24,893-pt support mentioned previously, which signals that the positive sentiment stays intact. The long lower shadow implies that there was initial selling momentum during the day before the market moved by the end of the trading session – indicating that the buyers ought to still have control over the market. Overall, we remain positive in our outlook.

As shown in the chart, we are eyeing the immediate support level at 24,893 pts, which was the low of 12 Oct’s “Bullish Harami” pattern. The next support is seen at 23,978 pts, determined from the previous low of 28 Jun. To the upside, the immediate resistance level is anticipated at 25,845 pts, ie the high of 17 Oct. If a breakout occurs, look to 26,522 pts – which was the high of 10 Oct’s long black candle – as the next resistance.

Hence, we advise traders to maintain long positions, following our recommendation of initiating long above the 25,500-pt level on 17 Oct. Meanwhile, a stop-loss can be set below the 24,893-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 24 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024