FKLI - Bearish Bias Extends

rhboskres

Publish date: Wed, 24 Oct 2018, 04:41 PM

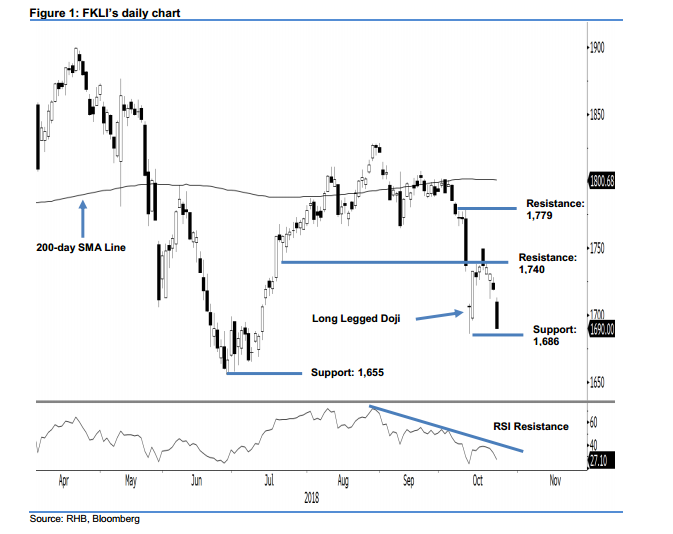

Maintain short positions as bears are still in firm control. The FKLI formed a black candle in yesterday’s trading – indicating it was under the bears’ control. The intraday tone was negative, as the index generally trended lower for the entire session from a high of 1,713 pts to settle at the low of1,690 pts – a decline of 29 pts. The bearish session continues to suggest that the negative bias, which had set in after the index was rejected decisively from the 200-day SMA line on 10 Oct, is still developing. Should the immediate support of 1,686 pts be broken in the coming sessions, chances are high that the weakening trend could extend further. Hence, we maintain our negative trading bias.

As the index is still firmly under the bears’ control, we continue to recommend that traders keep to short positions – which we initiated at 1,737 pts, or 10 Oct’s closing level. For risk management purposes, a stop loss can be placed above 1,779 pts.

The immediate support is pegged at 1,686 pts, the low of 11 Oct. This is followed by 1,655-pt level, the low of 28 June. On the other hand, the immediate resistance is at 1,740 pts, or 20 Jul’s low. This is followed by 1,779 pts – the latest session’s high.

Source: RHB Securities Research - 24 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024