COMEX Gold - Pushing Higher

rhboskres

Publish date: Wed, 24 Oct 2018, 04:51 PM

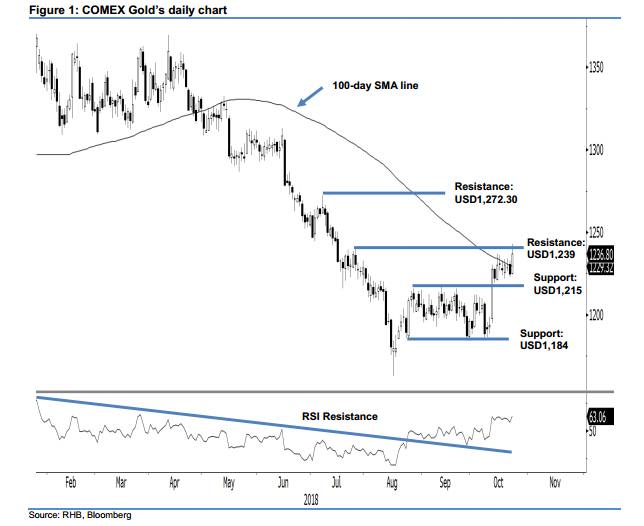

Maintain long positions as bulls charging forward. The COMEX Gold formed a white candle during the latest trading session and in the process, attempted to break out from its recent minor consolidation zone, as well as the immediate resistance of USD1,239. The commodity printed a low and high of USD1,224.50 and USD1,243, before settling at USD1,236.80, implying a gain of USD12.20. The positive session continue to lend support to the overall positive bias. If the said immediate resistance is breached in the coming sessions, it will likely signal a breakout from the minor consolidation phase, as well as the 100-day SMA line. Based on these, we are keeping our positive trading bias.

With the positive trend continuing to develop without any signs of exhaustion, we continue to advise traders to keep their long positions. Recall that we initiated these positions after the precious metal breached above the USD1,207.60 mark on 12 Sep. For risk management purposes, we revise a stop-loss below USD1,219.30, or the low of 12 Oct.

An immediate support remains at the USD1,215 mark, or 20 Jul’s low. This is followed by USD1,184, which was the low of 24 Aug. Conversely, the immediate resistance is eyed at the USD1,239 level, which was 26 Jul’s high. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 24 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024