FKLI - No Change in Bearish Bias

rhboskres

Publish date: Thu, 25 Oct 2018, 04:29 PM

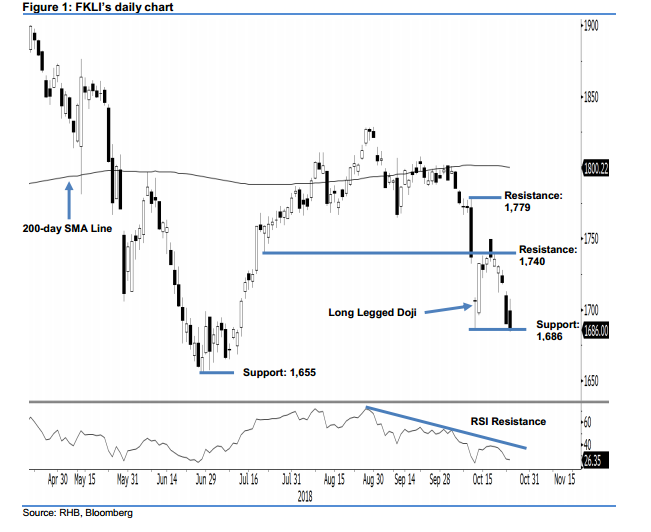

Maintain short positions as the bulls still being capped. The FKLI ended the latest session slightly lower and tested the immediate support 1,686 pts – failing to sustain its early session’s positive performance. The index slid lower after it posted a high of 1,707.5 pts, and low of 1,684.5 pts, before settling at 1,686 pts, – 4-pt decline. The bear’s ability to maintain control signals the overall weak trend and chances for a reversal to develop is still low as of now. The index’s negative set in after experiencing a sharp price rejection from the 200-day SMA line on 10 Oct. Hence, we maintain our negative trading bias.

As the bears come closer to test the said immediate support once again, we continue to recommend that traders keep to short positions – which we initiated at 1,737 pts, or 10 Oct’s closing level. For risk management purposes, a stop loss can be placed above 1,779 pts.

The immediate support is maintained at 1,686 pts, the low of 11 Oct. The second support is expected at 1,655-pt level, the low of 28 June. Towards the upside, the immediate resistance is at 1,740 pts, or 20 Jul’s low. This is followed by 1,779 pts – the latest session’s high.

Source: RHB Securities Research - 25 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024