FCPO - SMA Lines Under Pressure

rhboskres

Publish date: Thu, 25 Oct 2018, 04:30 PM

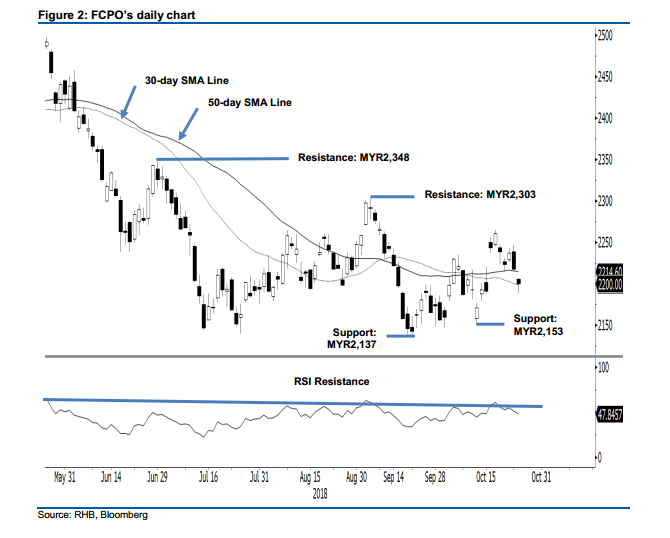

Maintain long positions. The FCPO formed a black candle in the latest session - at the closing, it marginally crossed the 50-day SMA line and came close to test the 30-day SMA line. The session’s low and high were recorded at MYR2,189 and MYR2,207, before ending MYR18 lower at MYR2,200. While there is a higher risk that the commodity’s rebound phase has reached the end – as the said SMA lines are under the pressure from the bears – a firm breach of the immediate support of MYR2,153 is needed to confirm such a possibility. The daily RSI reading of 47.85 also indicates that the rebound has not been stretched. Hence, we maintain our positive trading bias.

As there is no confirmation that the YTD retracement is returning, we continue to recommend traders keep to long positions. To recap, we initiate these positions at MYR2,244, or the closing level of 16 Oct. For risk management purposes, a stop-loss can be placed below MYR2,153.

Towards the downside, the immediate support is set at MYR2,153, the low of 11 Oct. This is followed by MYR2,137, the low of 20 Sep. Conversely, the immediate resistance is set at MYR2,303, the high of 5 Sep. This is followed by MYR2,348, the high of 29 Jun.

Source: RHB Securities Research - 25 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024