COMEX Gold - Testing a Wall of Resistances

rhboskres

Publish date: Thu, 25 Oct 2018, 04:37 PM

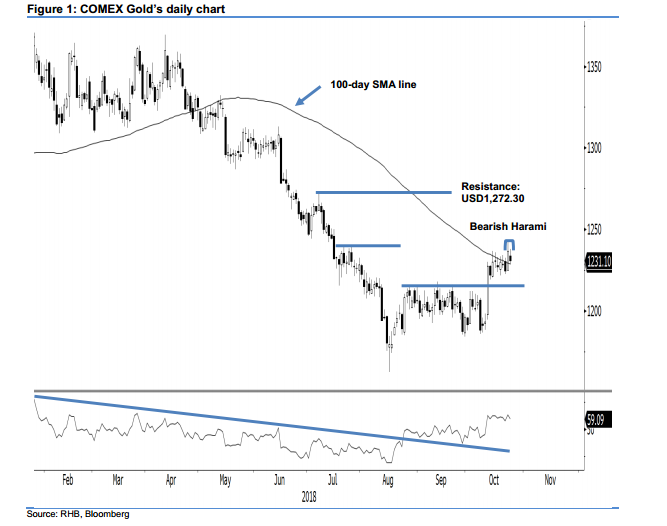

Maintain long positions. The COMEX Gold ended its latest session negatively. For the intraday, the commodity swung between a low and high of USD1,228.30 and USD1,238 before ending USD5.70 softer at USD1,231.10. Consequently, a “Bearish Harami” formation was formed – an early signal that the rebound so far may have reached an end. However, until firmer negative price signals emerge – in this case a downside break of the USD1,215 immediate support – the overall positive bias remains in place. For now, the probability is higher that the commodity is merely consolidating below both the USD1,239 immediate resistance and 100-day SMA line. We are keeping our positive trading bias.

As the bias is still for the precious metal to extend its upward move, we continue to advise traders to keep their long positions. Recall that we initiated these positions after the COMEX Gold breached above the USD1,207.60 mark on 12 Sep. For risk-management purposes, a stop-loss can be placed at below USD1,219.30, which was the low of 12 Oct.

Towards the downside, immediate support is at the USD1,215 mark, or 20 Jul’s low. The following support is at USD1,184, which was the low of 24 Aug. Moving up, the immediate resistance is eyed at the USD1,239 level, ie 26 Jul’s high. This is followed by the USD1,272.30 threshold, or the high of 9 Jul.

Source: RHB Securities Research - 25 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024