COMEX Gold - Consolidation Mode Continue

rhboskres

Publish date: Fri, 26 Oct 2018, 04:16 PM

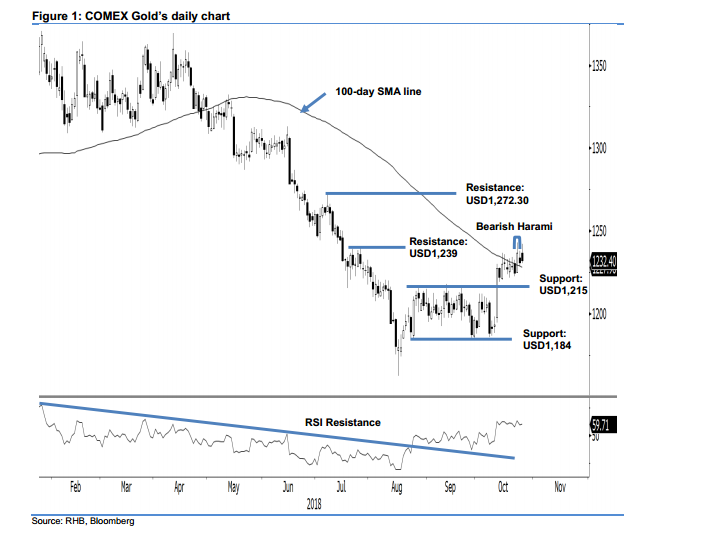

Maintain long positions as bulls are still trying to crack the resistance zone. The COMEX Gold ended the latest session on a positive note, at one point testing the immediate resistance of USD1,239. The precious metal gained UD1.30 to settle at USD1,232.40, after it swung between a low and high of USD1,230.50 and USD1,242. The recent sessions continued to suggest that the bulls are consolidating near the 100-day SMA line and the said immediate resistance. A firm breach from this resistance zone will likely signal that the commodity is extending its upward move. The daily RSI reading of 59.71 indicates the rebound so far is not being stretched. We are keeping our positive trading bias.

As price actions around the said resistance are still constructive, we continue to advise traders to keep their long positions. Recall that we initiated these positions after the COMEX Gold breached above the USD1,207.60 mark on 12 Sep. For risk management purposes, a stop-loss can be placed at below USD1,219.30, which was the low of 12 Oct.

Immediate support is maintained at the USD1,215 mark, or 20 Jul’s low. The second support is at USD1,184, which was the low of 24 Aug. On the other hand, the immediate resistance is eyed at the USD1,239 level, ie 26 Jul’s high. This is followed by the USD1,272.30 threshold, or the high of 9 Jul.

Source: RHB Securities Research - 26 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024