WTI Crude Future - Still No Signs of Reversing

rhboskres

Publish date: Fri, 26 Oct 2018, 04:18 PM

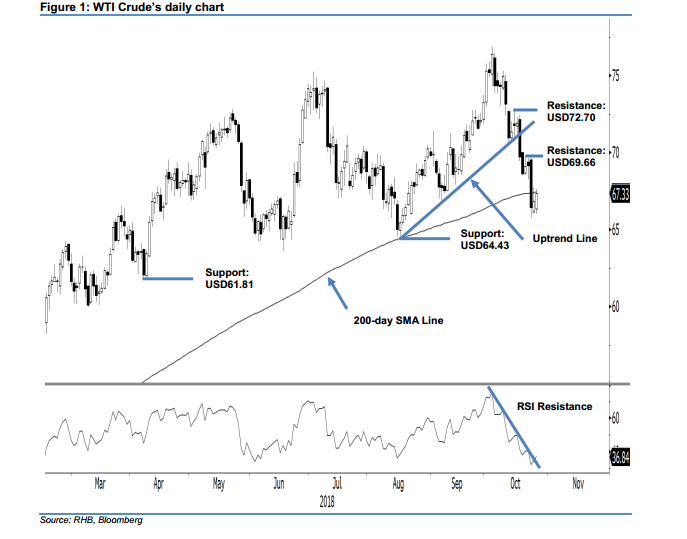

Maintain short positions as the commodity is consolidating below the 200-day SMA. The WTI Crude formed a white candle in the latest trading session, settling at USD67.33. This indicates a gain of USD0.51. The session’s low and high were at USD65.99 and USD67.65. The weakening bias is still in place as the last two sessions’ performances can be seen as signs that the commodity is consolidating below the 200-day SMA line, and correcting its recent sharp retracement. On the upside, should the 200-day SMA line be recaptured decisively, the chances would be better for the commodity to pose a deeper rebound. Hence, we maintain our negative trading bias.

As there is still no technical evidence to suggest that the weakening trend has reached an end, we continue to recommend traders to keep to short positions. We initiated short positions at USD70.97, which was the closing of 11 Oct. For risk management purposes, a stop-loss can be placed above the USD69.66 mark.

Immediate support is expected to emerge at USD64.43, or the low of 16 Aug. Breaking this may see the commodity test USD61.81, which was the low of 6 Apr. Conversely, the immediate resistance is pegged at USD69.66, ie the high of the latest session. This is followed by USD72.70, which was 15 Oct’s high.

Source: RHB Securities Research - 26 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024